International Travel House Share Price Target Tomorrow 2025 To 2030

International Travel House Limited (ITHL), established in 1981, is India’s first publicly listed travel company and a leading provider of comprehensive travel management services. As an associate company of ITC Hotels, ITHL offers a diverse range of services, including business travel, car rentals, hotel bookings, meetings and events (MICE), leisure travel, and travel concierge solutions. International Travel House Share Price on NSE as of 5 May 2025 is 510.50 INR.

International Travel House Share Market Overview

- Open: 533.60

- High: 533.60

- Low: 505.60

- Previous Close: 518.30

- Volume: 3,633

- Value (Lacs): 18.55

- VWAP: 512.43

- 52 Week High: 750.00

- 52 Week Low: 380.00

- Mkt Cap (Rs. Cr.): 408

- Face Value: 10

International Travel House Share Price Chart

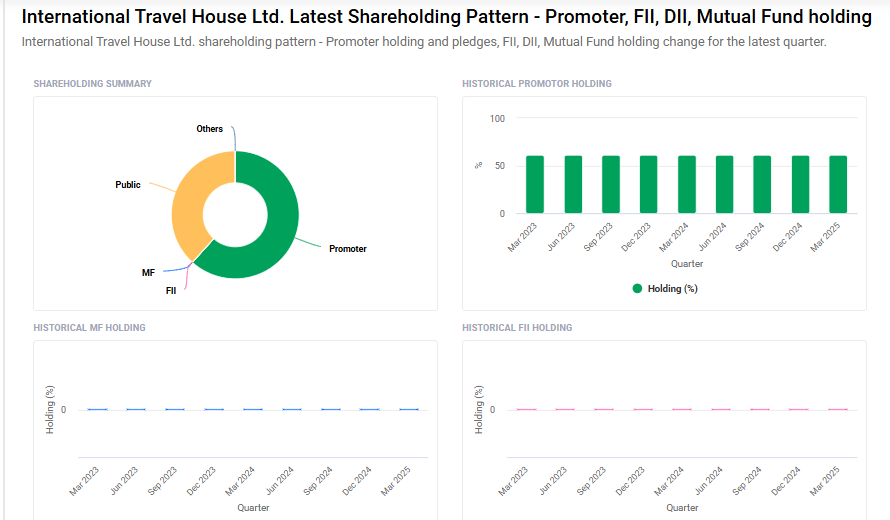

International Travel House Shareholding Pattern

- Promoters: 61.7%

- FII: 0%

- DII: 0%

- Public: 38.3%

International Travel House Share Price Target Tomorrow 2025 To 2030

| International Travel House Share Price Target Years | International Travel House Share Price |

| 2025 | ₹760 |

| 2026 | ₹850 |

| 2027 | ₹950 |

| 2028 | ₹1050 |

| 2029 | ₹1150 |

| 2030 | ₹1250 |

International Travel House Share Price Target 2025

International Travel House share price target 2025 Expected target could ₹760. Here are four key factors that could influence the growth of International Travel House Ltd. (ITHL):

1. Resurgence in Corporate Travel Demand

As global business activities rebound post-pandemic, there’s a notable increase in corporate travel requirements. ITHL, with its comprehensive travel management solutions, is well-positioned to capitalize on this trend, potentially boosting its revenue streams.

2. Strategic Partnerships and Business Expansions

The company’s efforts in forging strategic alliances and expanding its service offerings enhance its market presence. Such initiatives can lead to diversified revenue sources and improved operational efficiencies, contributing to overall growth.

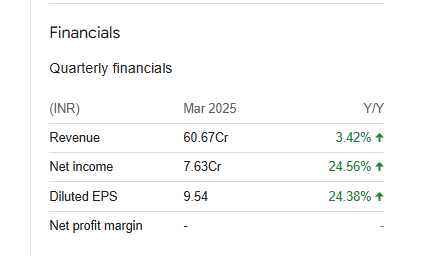

3. Robust Financial Performance

ITHL reported a net profit of ₹7.63 crore in Q4 FY2024-25, marking a 24.47% year-over-year increase. This strong financial performance reflects the company’s effective cost management and operational strategies, which can instill investor confidence.

4. Attractive Valuation Metrics

With a Price-to-Earnings (P/E) ratio of 15.03, ITHL is trading at a valuation lower than the industry average. This suggests potential undervaluation, making it an attractive proposition for investors seeking growth opportunities.

International Travel House Share Price Target 2030

International Travel House share price target 2030 Expected target could ₹1250. Here are four key Risks and Challenges that could affect International Travel House Ltd:

1. Dependence on Corporate Travel Segment

ITHL generates a significant portion of its revenue from business travel services. A shift in corporate behavior toward virtual meetings or long-term reductions in corporate travel budgets could limit growth opportunities and reduce demand for its services.

2. High Competition in the Travel Industry

The travel and hospitality industry is highly competitive, with large players and online booking platforms offering integrated and often lower-cost solutions. Intense competition can squeeze margins and challenge ITHL’s ability to maintain market share.

3. Economic and Geopolitical Sensitivity

The travel industry is sensitive to macroeconomic conditions and global events like pandemics, inflation, or geopolitical tensions. Any such disruptions can lead to a sudden drop in travel demand, directly impacting ITHL’s revenue and profitability.

4. Limited Diversification in Service Offerings

Compared to major travel conglomerates, ITHL has a relatively narrow focus on corporate travel, car rentals, and hotel bookings. Without broader diversification or digital innovation, the company may find it challenging to adapt to rapidly changing travel trends and customer preferences.

International Travel House Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 2.36B | 8.42% |

| Operating expense | 468.63M | -66.83% |

| Net income | 271.52M | 20.66% |

| Net profit margin | — | — |

| Earnings per share | — | — |

| EBITDA | 375.05M | 13.27% |

| Effective tax rate | 26.19% | — |

Read Also:- Munjal Auto Share Price Target Tomorrow 2025 To 2030