JP Associates Share Price Target Tomorrow 2025 To 2030

Jaiprakash Associates Ltd, also known as JP Associates, is an Indian company involved in sectors like engineering, construction, cement, and power. It is part of the larger Jaypee Group, which has played a key role in building important infrastructure across the country, including roads, dams, and power plants. In recent years, the company has faced financial difficulties due to high debt and tough market conditions. JP Associates Share Price on NSE as of 23 May 2025 is 2.85 INR.

JP Associates Share Market Overview

- Open: 2.85

- High: 2.85

- Low: 2.85

- Mkt cap: 700.28Cr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 16.95

- 52-wk low: 2.81

JP Associates Share Price Chart

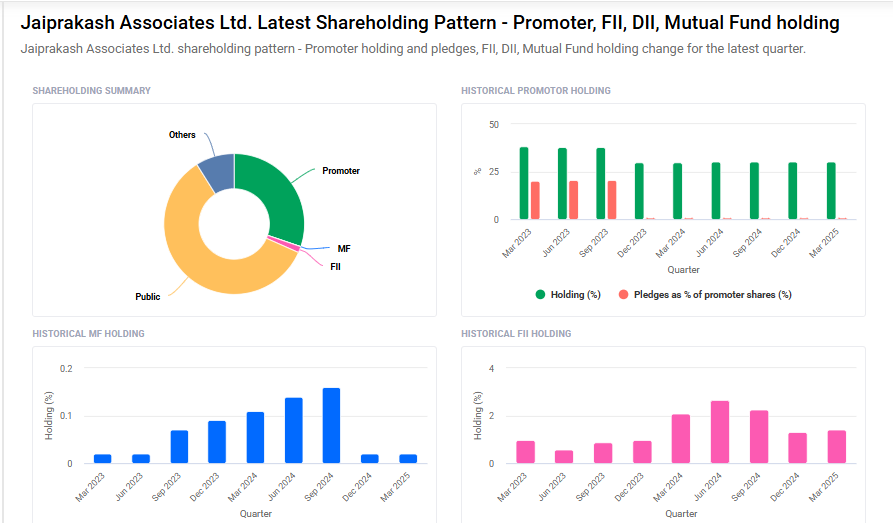

JP Associates Shareholding Pattern

- Promoters: 30.2%

- FII: 1.4%

- DII: 8.9%

- Public: 59.5%

JP Associates Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹18 |

| 2026 | ₹22 |

| 2027 | ₹27 |

| 2028 | ₹32 |

| 2029 | ₹37 |

| 2030 | ₹42 |

JP Associates Share Price Target 2025

JP Associates share price target 2025 Expected target could ₹18. Here are five key factors that could influence the growth of Jaiprakash Associates Ltd. (JP Associates) and its share price by 2025:

1. Projected Revenue and Operating Income Growth

After experiencing a revenue decline of -12% over the past eight years, JP Associates is projected to achieve a compound annual growth rate (CAGR) of 13% in revenue and 71% in operating income over the next eight years.

2. Analyst Price Target

Analysts have set a consensus target price of ₹80 for JP Associates shares, representing a substantial upside from the current price of ₹2.85.

3. Asset Monetization and Debt Reduction

JP Associates has been actively working on reducing its debt through asset sales, including cement and power assets. Successful execution of these plans can improve the company’s financial health and investor confidence.

4. Market Sentiment and Technical Indicators

Recent technical analyses have issued buy signals for JP Associates stock, suggesting potential upward momentum.

5. Industry Trends and Infrastructure Development

India’s focus on infrastructure development presents opportunities for companies like JP Associates. Participation in large-scale projects can drive revenue growth and enhance the company’s market position.

JP Associates Share Price Target 2030

JP Associates share price target 2030 Expected target could ₹42. Here are five key risks and challenges that could impact Jaiprakash Associates Ltd. (JP Associates) and its share price target by 2030:

1. High Debt and Insolvency Proceedings

JP Associates is burdened with substantial debt, leading to insolvency proceedings under the Insolvency & Bankruptcy Code (IBC). The company’s shares have been suspended from trading since August 2024 due to these proceedings. Although a ₹16,000 crore settlement offer was made to creditors, its acceptance remains uncertain, posing a significant risk to the company’s financial stability and future operations.

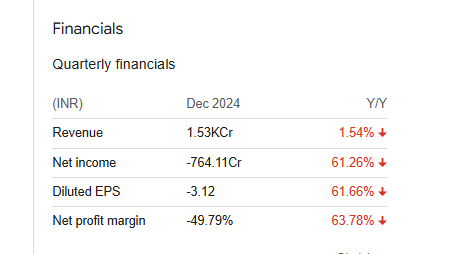

2. Negative Profit Margins and Weak Financial Performance

JP Associates has reported negative earnings, with a net loss of ₹2,144 crore and a net profit margin of -33.95%. Such financial indicators reflect ongoing operational challenges and raise concerns about the company’s ability to achieve profitability in the near future.

3. Volatile Share Price and Investor Caution

The company’s share price has experienced significant volatility, with an average weekly movement of 10.2%, higher than the industry average. This volatility, coupled with underperformance relative to industry and market benchmarks, may deter potential investors and affect long-term share price stability.

4. Regulatory and Legal Challenges

JP Associates has faced regulatory scrutiny and legal challenges, including investigations into financial irregularities. Such issues can lead to reputational damage, legal penalties, and further financial strain, impacting the company’s operations and investor confidence.

5. Asset Monetization Uncertainties

Efforts to monetize assets, such as cement and power divisions, have faced obstacles, including uncertainties in deal finalizations. For instance, Dalmia Bharat’s agreement to acquire JP Associates’ cement assets faced challenges due to the company’s insolvency proceedings, highlighting the complexities in executing such transactions.

JP Associates Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 67.56B | -9.18% |

| Operating expense | 12.32B | 5.23% |

| Net income | -13.40B | 0.14% |

| Net profit margin | -19.83 | -9.92% |

| Earnings per share | — | — |

| EBITDA | 6.48B | -30.91% |

| Effective tax rate | -4.19% | — |

Read Also:- Vi Share Price Target Tomorrow 2025 To 2030