Keltech Energies Share Price Target Tomorrow 2025 To 2030

Keltech Energies Ltd., established in 1977, is a public limited company based in Bangalore, India. As a part of the esteemed Chowgule Group, which has diverse interests in sectors like mining, shipping, and industrial chemicals, Keltech specializes in manufacturing industrial explosives and perlite-based products. Their product range includes cartridge explosives, bulk emulsion explosives, mono methyl amine nitrate (MMAN) solutions, and accessories for explosives. Keltech Energies Share Price on BOM as of 10 May 2025 is 3,251.00 INR.

Keltech Energies Share Market Overview

- Open: 3,102.00

- High: 3,344.00

- Low: 3,102.00

- Previous Close: 3,285.30

- Volume: 693

- Value (Lacs): 22.53

- VWAP: 3,212.02

- UC Limit: 3,868.30

- LC Limit: 2,578.90

- 52 Week High: 4,520.95

- 52 Week Low: 2,486.20

- Mkt Cap (Rs. Cr.): 325

- Face Value: 10

Keltech Energies Share Price Chart

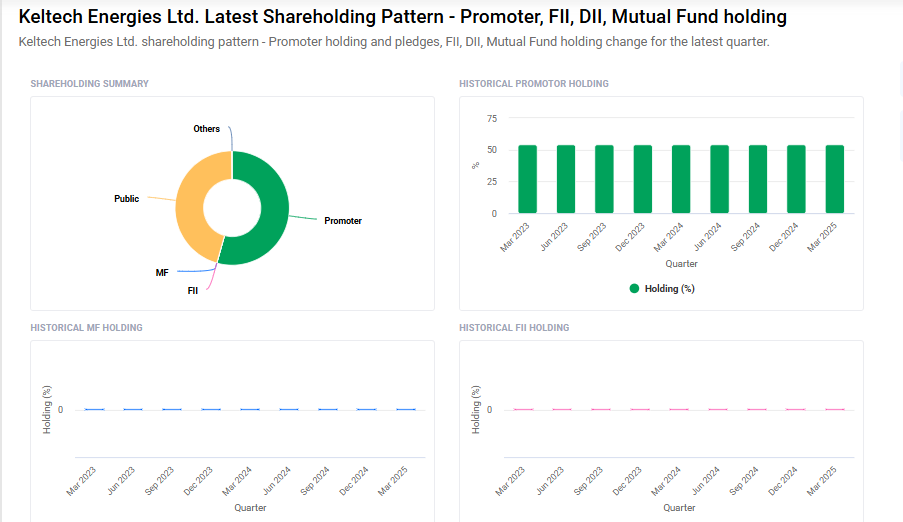

Keltech Energies Shareholding Pattern

- Promoters: 54.3%

- FII: 0%

- DII: 0.1%

- Public: 45.5%

Keltech Energies Share Price Target Tomorrow 2025 To 2030

| Keltech Energies Share Price Target Years | Keltech Energies Share Price |

| 2025 | ₹5100 |

| 2026 | ₹5300 |

| 2027 | ₹5500 |

| 2028 | ₹5700 |

| 2029 | ₹5900 |

| 2030 | ₹6100 |

Keltech Energies Share Price Target 2025

Keltech Energies share price target 2025 Expected target could ₹5100. Here are four key factors that could influence Keltech Energies Ltd.‘s share price target for 2025:

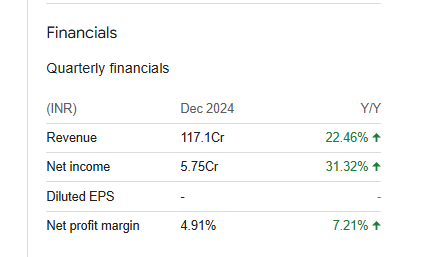

1. Strong Financial Performance in FY2024–25

Keltech Energies demonstrated robust financial growth in the third quarter of FY2024–25, with revenue increasing by 22.4% year-over-year to ₹118.34 crore and net profit rising by 31.28% to ₹5.75 crore. The company also achieved its highest operating profit margin in five quarters, indicating improved operational efficiency.

2. Diversified Product Portfolio

The company’s diverse range of products—including cartridge explosives, bulk emulsion explosives, mono methyl amine nitrate (MMAN) solutions, and expanded perlite—positions it to cater to various sectors such as mining, construction, and agriculture. This diversification can help stabilize revenues and reduce dependence on a single market segment.

3. Affiliation with the Chowgule Group

Keltech Energies is part of the US $300 million Chowgule Group, which has interests in mining, shipping, shipbuilding, industrial salts, automobiles, construction chemicals, iron ore, pelletization, industrial gases, explosives, expanded perlite, and exports. This affiliation provides strategic advantages, including access to a broad network and potential synergies across industries.

4. Positive Industry Outlook

The industrial explosives market in the Asia-Pacific region is projected to expand at a compound annual growth rate (CAGR) of 33.5%, driven by the growth of metals and non-metals industries. Keltech Energies, with its established presence in the explosives sector, stands to benefit from this industry growth.

Keltech Energies Share Price Target 2030

Keltech Energies share price target 2030 Expected target could ₹6100. Here are four key risks and challenges that could impact Keltech Energies Ltd.‘s share price target by 2030:

1. Profitability Concerns and Operational Efficiency

Keltech Energies has faced challenges in maintaining consistent profitability. For instance, in September 2024, the company’s Profit Before Depreciation, Interest, and Taxes (PBDIT) stood at ₹7.37 crore, marking one of the lowest figures observed to date. Additionally, the operating profit to net sales ratio for the quarter was 7.19%, suggesting ongoing profitability issues that could impact investor sentiment.

2. Industry Competition and Market Dynamics

Operating in the chemicals industry, Keltech Energies faces stiff competition from both domestic and international players. The company’s financial stability, as indicated by an Altman Z score of 4.61, ranks it 5th out of its 8 competitors, suggesting that it may be less financially stable compared to its peers.

3. Regulatory and Operational Risks

The company operates in a sector that is subject to stringent government regulations, particularly concerning licensing and safety standards. Additionally, Keltech Energies faces challenges such as a shortage of skilled labor and competition in domestic and local markets. These factors can pose significant risks to its operations and profitability.

4. Stock Volatility and Investor Sentiment

Keltech Energies’ stock has experienced significant volatility. For example, despite reaching a 52-week high of ₹4,288.75 in April 2024, the stock has shown fluctuations, which can affect investor confidence and long-term valuation.

Keltech Energies Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 4.50B | -20.09% |

| Operating expense | 911.23M | 14.77% |

| Net income | 194.13M | 62.84% |

| Net profit margin | 4.31 | 103.30% |

| Earnings per share | — | — |

| EBITDA | 336.25M | 28.29% |

| Effective tax rate | 25.46% | — |

Read Also:- Maestros Electronics Share Price Target Tomorrow 2025 To 2030