KRN Heat Exchanger Share Price Target Tomorrow 2025 To 2030

KRN Heat Exchanger and Refrigeration Limited, established in 2017 and headquartered in Neemrana, Rajasthan, is a prominent manufacturer specializing in fin and tube-type heat exchangers. The company offers a diverse product range, including condenser coils, evaporator units, fluid and steam coils, and sheet metal parts, catering primarily to the HVAC&R (Heating, Ventilation, Air Conditioning, and Refrigeration) industry. Utilizing high-quality copper and aluminum materials, KRN’s products are designed to meet international standards, with certifications such as ISO 9001:2015 for Quality Management Systems and UL-207 recognition. KRN Heat Exchanger Share Price on NSE as of 25 April 2025 is 806.00 INR.

KRN Heat Exchanger Share Market Overview

- Open: 822.80

- High: 830.95

- Low: 805.80

- Previous Close: 821.45

- Volume: 432,776

- Value (Lacs): 3,516.30

- 52 Week High: 1,012.00

- 52 Week Low: 220.00

- Mkt Cap (Rs. Cr.): 5,050

- Face Value: 10

KRN Heat Exchanger Share Price Chart

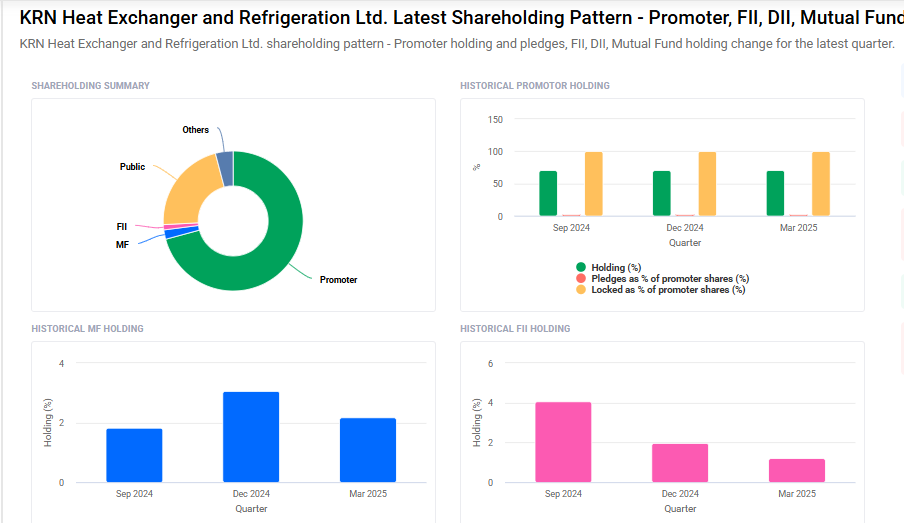

KRN Heat Exchanger Shareholding Pattern

- Promoters: 70.8%

- FII: 1.2%

- DII: 6.3%

- Public: 21.7%

KRN Heat Exchanger Share Price Target Tomorrow 2025 To 2030

| KRN Heat Exchanger Share Price Target Years | KRN Heat Exchanger Share Price |

| 2025 | ₹1020 |

| 2026 | ₹1400 |

| 2027 | ₹1800 |

| 2028 | ₹2200 |

| 2029 | ₹2600 |

| 2030 | ₹3000 |

KRN Heat Exchanger Share Price Target 2025

Here are four key factors that could influence the growth of KRN Heat Exchanger’s share price by 2025:

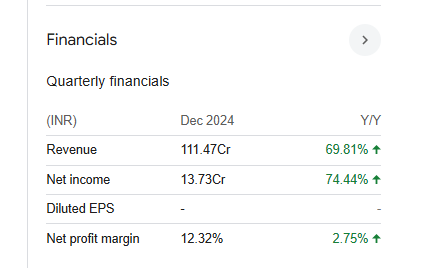

1. Strong Financial Performance

KRN Heat Exchanger has demonstrated impressive financial growth. In the third quarter of FY2025, the company reported a revenue of ₹1.16 billion, marking a 58% increase compared to the same period in the previous year. Net income also rose by 39% year-over-year, reaching ₹137.3 million. These figures reflect the company’s robust operational efficiency and market demand for its products.

2. Expanding Market Demand

The heat exchanger industry in India is experiencing rapid growth, driven by industrialization and infrastructure development. The market, valued at USD 689 million in 2023, is projected to grow at a CAGR of 11.6%, reaching USD 1.49 billion by 2030. This expanding market presents significant opportunities for KRN Heat Exchanger to increase its market share and revenues.

3. Strategic Expansion Plans

KRN Heat Exchanger is undertaking major expansion initiatives to meet rising demand. The company is increasing its manufacturing capacity and diversifying its product lines, including the introduction of bar and plate heat exchangers and roll bond heat exchangers. These efforts aim to cater to a broader range of applications, such as the growing data center segment.

4. Strong Client Relationships

The company has established strong relationships with leading firms, including Daikin Airconditioning, Schneider Electric, Kirloskar Chillers, Blue Star, Climaventa Climate Technologies, and Frigel Intelligent Cooling Systems. These partnerships not only provide a steady revenue stream but also enhance KRN’s reputation in the industry.

KRN Heat Exchanger Share Price Target 2030

Here are four different risks and challenges that could affect the KRN Heat Exchanger share price target by 2030:

1. Market Competition

The heat exchanger industry is becoming more competitive with the entry of new players and the growth of existing ones. If KRN Heat Exchanger cannot keep up with innovations or offer competitive pricing, it might lose customers to other companies. This can slow down its revenue and affect its share price in the long run.

2. Raw Material Price Fluctuations

The company relies heavily on metals like copper, aluminum, and steel for its products. If the prices of these materials go up, KRN’s manufacturing costs will also increase. This could reduce profit margins unless the company can pass those costs on to customers.

3. Economic Slowdowns

KRN Heat Exchanger’s business depends on industrial and commercial demand. During economic slowdowns, construction, manufacturing, and infrastructure projects may be delayed or reduced. This can directly impact sales and revenue growth, putting pressure on the stock price.

4. Dependency on Key Clients

A large portion of KRN’s revenue comes from a few major clients. If any of these clients reduce their orders or switch to a competitor, it could have a big negative impact on the company’s financial health and share price.

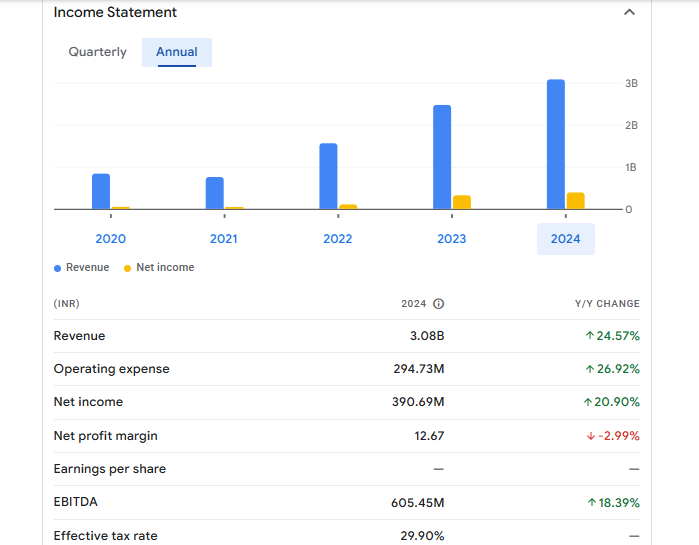

KRN Heat Exchanger Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 3.08B | 24.57% |

| Operating expense | 294.73M | 26.92% |

| Net income | 390.69M | 20.90% |

| Net profit margin | 12.67 | -2.99% |

| Earnings per share | — | — |

| EBITDA | 605.45M | 18.39% |

| Effective tax rate | 29.90% | — |

Read Also:- Surana Solar Share Price Target Tomorrow 2025 To 2030