Motherson Sumi Share Price Target Tomorrow 2025 To 2030

Motherson Sumi, now known as Samvardhana Motherson International Ltd. (SAMIL), is a prominent Indian multinational company specializing in automotive components. Established in 1986 as a joint venture between the Motherson Group and Sumitomo Wiring Systems of Japan, the company began by supplying wiring harnesses to Maruti Udyog. Over the years, it has expanded its product range to include rearview mirrors, plastic components, and various other automotive parts. Today, SAMIL operates over 350 facilities across 41 countries, employing more than 180,000 people worldwide. Motherson Sumi Share Price on NSE as of 2 May 2025 is 132.87 INR.

Motherson Sumi Share Market Overview

- Open: 135.50

- High: 135.50

- Low: 131.77

- Previous Close: 136.08

- Volume: 18,806,115

- Value (Lacs): 25,062.91

- 52 Week High: 216.99

- 52 Week Low: 107.25

- Mkt Cap (Rs. Cr.): 93,772

- Face Value: 1

Motherson Sumi Share Price Chart

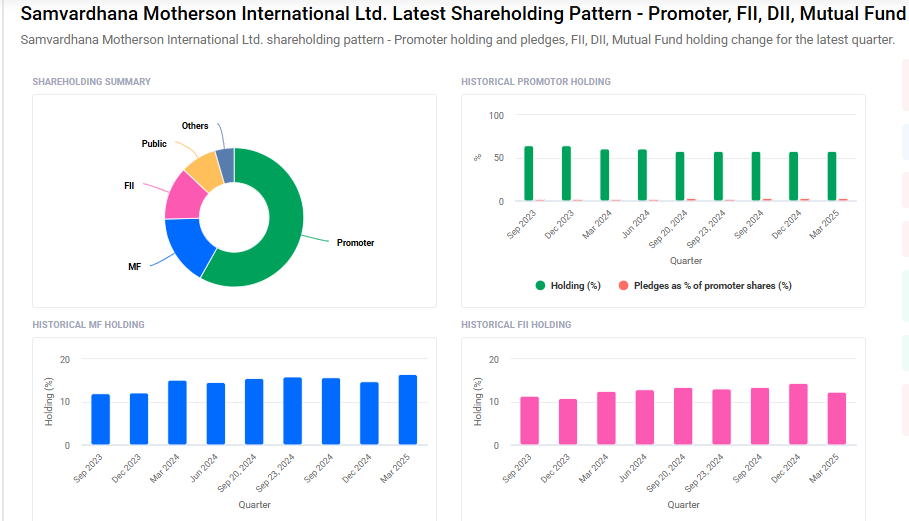

Motherson Sumi Shareholding Pattern

- Promoters: 58.1%

- FII: 12.4%

- DII: 21%

- Public: 8.4%

Motherson Sumi Share Price Target Tomorrow 2025 To 2030

| Motherson Sumi Share Price Target Years | Motherson Sumi Share Price |

| 2025 | ₹220 |

| 2026 | ₹250 |

| 2027 | ₹270 |

| 2028 | ₹290 |

| 2029 | ₹310 |

| 2030 | ₹330 |

Motherson Sumi Share Price Target 2025

Motherson Sumi share price target 2025 Expected target could ₹220. Here are four key factors influencing the growth of Motherson Sumi and its share price target for 2025:

1. Vision 2025: Ambitious Revenue and Diversification Goals

Motherson Sumi has outlined an ambitious “Vision 2025” plan, aiming to achieve $36 billion in consolidated revenue with a 40% Return on Capital Employed (ROCE). The strategy includes generating 75% of revenue from the automotive sector and 25% from non-automotive divisions such as medical, aerospace, logistics, and IT. This diversification is intended to reduce dependency on the automotive industry and tap into new growth areas.

2. Expansion into New Markets and Technologies

The company is focusing on expanding into new geographies and adopting advanced technologies in its existing products. This includes increasing content per vehicle through new technology products and entering new segments and markets. Such initiatives are expected to drive organic growth and enhance the company’s global footprint.

3. Strategic Acquisitions and Inorganic Growth

Motherson Sumi plans to pursue inorganic growth through strategic acquisitions, particularly in the automotive business and new industries like aerospace and medical technologies. These acquisitions are aimed at accelerating growth and achieving the company’s Vision 2025 targets.

4. Strong Financial Performance and Investor Confidence

Analysts have shown confidence in Motherson Sumi’s growth prospects. For instance, ICICI Securities has a buy call on the company with a target price of ₹185, citing expectations of significant revenue growth driven by new products and market expansion.

Motherson Sumi Share Price Target 2030

Motherson Sumi share price target 2030 Expected target could ₹330. Here are four key Risks and Challenges that could affect Motherson Sumi and its share price target by 2030:

1. Dependence on the Automotive Industry

Motherson Sumi derives a significant portion of its revenue from the automotive sector. Any downturn in global automotive demand, shifts towards electric vehicles, or disruptions in the supply chain could adversely impact the company’s financial performance and, consequently, its share price.

2. High Valuation Metrics

The company has been trading at elevated valuation levels, with a Price-to-Earnings (PE) ratio of 77 and an EBITDA multiple of 48.01. Such high valuations may not be sustainable if the company fails to meet growth expectations, potentially leading to a correction in its share price.

3. Low Return Ratios

Over the past three years, Motherson Sumi has reported relatively low Return on Equity (ROE) and Return on Capital Employed (ROCE) ratios, at 3.89% and 3.78% respectively. These figures suggest challenges in efficiently utilizing capital to generate profits, which could be a concern for long-term investors.

4. Global Economic and Geopolitical Risks

As a multinational company with operations across various countries, Motherson Sumi is exposed to global economic fluctuations and geopolitical tensions. Factors such as trade wars, changes in international trade policies, or economic slowdowns in key markets could pose risks to its operations and profitability.

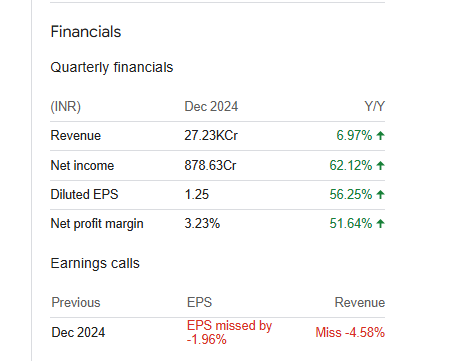

Motherson Sumi Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 981.55B | 25.49% |

| Operating expense | 364.58B | 28.60% |

| Net income | 27.16B | 81.61% |

| Net profit margin | 2.77 | 45.03% |

| Earnings per share | 4.30 | 85.98% |

| EBITDA | 85.51B | 45.69% |

| Effective tax rate | 21.37% | — |

Read Also:- Ambuja Cements Share Price Target Tomorrow 2025 To 2030