NBCC Share Price Target Tomorrow 2025 To 2030

NBCC (India) Limited is a government-owned construction company that plays a key role in building and developing infrastructure across India. It is known for taking up big projects such as government buildings, housing complexes, and redevelopment of old structures in cities. As a Navratna company under the Ministry of Housing and Urban Affairs, NBCC enjoys strong support from the Indian government, which helps it secure major public sector contracts. NBCC Share Price on NSE as of 19 May 2025 is 110.84 INR.

NBCC Share Market Overview

- Open: 107.16

- High: 113.20

- Low: 106.55

- Previous Close: 106.72

- Volume: 27,415,877

- Value (Lacs): 30,453.56

- 52 Week High: 139.83

- 52 Week Low: 25.47

- Mkt Cap (Rs. Cr.): 29,991

- Face Value: 1

NBCC Share Price Chart

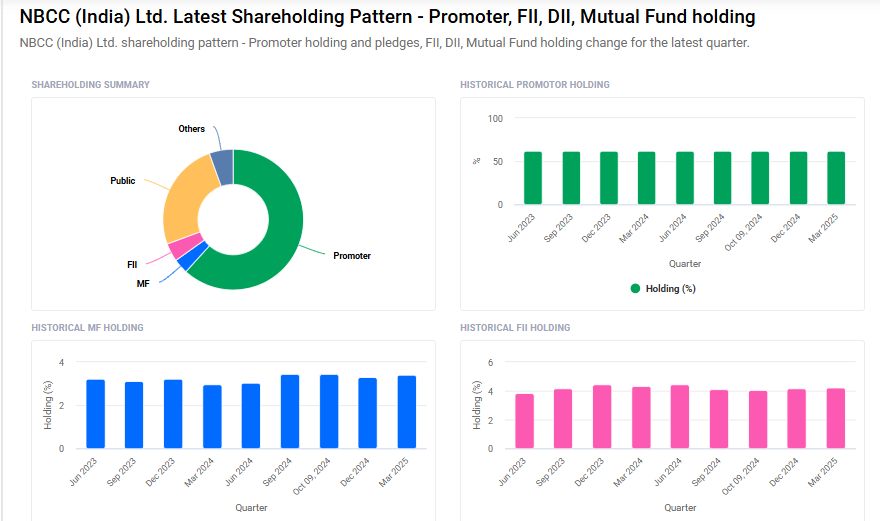

NBCC Shareholding Pattern

- Promoters: 61.8%

- FII: 4.2%

- DII: 8.9%

- Public: 25.1%

NBCC Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹140 |

| 2026 | ₹160 |

| 2027 | ₹180 |

| 2028 | ₹200 |

| 2029 | ₹220 |

| 2030 | ₹240 |

NBCC Share Price Target 2025

NBCC share price target 2025 Expected target could ₹140. Here are five key factors influencing NBCC (India) Limited’s share price target for 2025:

1. Strong Government Backing and Navratna Status

NBCC is a Government of India Navratna enterprise under the Ministry of Housing and Urban Affairs. This status provides the company with strategic importance and operational autonomy, enabling it to secure large-scale public sector projects. Such government backing enhances investor confidence and supports long-term growth prospects.

2. Robust Project Pipeline and Urban Redevelopment Initiatives

NBCC has a substantial order book, including significant projects like the redevelopment of Pragati Maidan and initiatives under schemes such as AMRUT and PMGSY. These projects not only contribute to revenue growth but also reinforce NBCC’s position as a leader in urban infrastructure development.

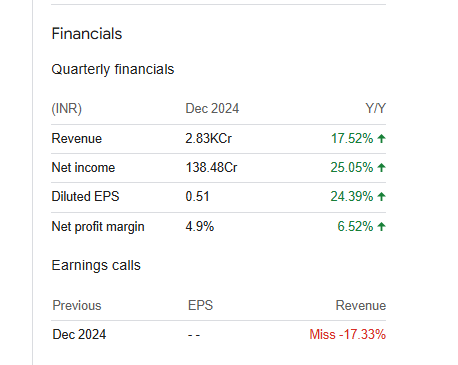

3. Positive Financial Performance

In Q3 of FY2024-25, NBCC reported a net profit increase of 25.05% year-over-year, reaching ₹138.48 crore. This strong financial performance indicates effective project execution and cost management, which are critical for sustaining investor interest and supporting share price appreciation.

4. Analyst Forecasts and Market Sentiment

Analysts have projected NBCC’s share price to reach between ₹72.12 and ₹113.46 by the end of 2025, with potential to climb to ₹164.28 to ₹190.36 by 2028. Such optimistic forecasts reflect positive market sentiment and expectations of continued growth.

5. Sustainable Construction Practices

NBCC’s commitment to sustainable construction, including the adoption of green building norms and waste management practices, aligns with global environmental standards. This focus on sustainability not only meets regulatory requirements but also appeals to environmentally conscious investors.

NBCC Share Price Target 2030

NBCC share price target 2030 Expected target could ₹240. Here are five key risks and challenges that could impact NBCC (India) Limited’s share price trajectory by 2030:

1. Execution Delays and Project Backlogs

NBCC’s extensive portfolio of government-backed projects, including urban redevelopment and infrastructure initiatives, is susceptible to delays due to bureaucratic procedures, land acquisition hurdles, and coordination challenges with various stakeholders. Such delays can lead to cost overruns and affect the company’s revenue recognition timelines.

2. Dependence on Government Contracts

A significant portion of NBCC’s revenue stems from government contracts. Any reduction in government spending on infrastructure or shifts in policy priorities could adversely affect the company’s order book and financial performance.

3. Real Estate Market Volatility

NBCC’s ventures into real estate development expose it to market risks such as fluctuating property prices, changing demand dynamics, and regulatory changes in the real estate sector. Economic downturns or unfavorable market conditions could impact the profitability of these projects.

4. Competitive Pressure from Private Sector

The construction and infrastructure sector is highly competitive, with private players often exhibiting greater agility and efficiency. NBCC may face challenges in maintaining its market share and profit margins amid intense competition, especially in projects where private firms are also bidders.

5. Macroeconomic and Regulatory Risks

Broader economic factors such as inflation, interest rate fluctuations, and changes in taxation or regulatory frameworks can impact NBCC’s operational costs and project viability. Additionally, any adverse changes in environmental regulations or labor laws could pose compliance challenges and affect project timelines.

NBCC Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 103.49B | 17.82% |

| Operating expense | 4.25B | 9.02% |

| Net income | 4.02B | 50.58% |

| Net profit margin | 3.88 | 27.63% |

| Earnings per share | 1.79 | 24.19% |

| EBITDA | 4.79B | 43.64% |

| Effective tax rate | 25.81% | — |

Read Also:- Inoc Wind Share Price Target Tomorrow 2025 To 2030