NMDC Steel Share Price Target Tomorrow 2025 To 2030

NMDC Steel Limited is a growing steel manufacturing company in India, formed after being separated from NMDC Limited, a well-known iron ore producer. The company operates a modern steel plant in Chhattisgarh with the goal of producing high-quality steel for infrastructure, construction, and other industries. Although it is relatively new in the steel business, NMDC Steel is working hard to expand its production capacity and improve efficiency. NMDC Steel Share Price on NSE as of 30 April 2025 is 35.63 INR.

NMDC Steel Share Market Overview

- Open: 35.50

- High: 36.24

- Low: 35.33

- Previous Close: 35.43

- Volume: 2,814,219

- Value (Lacs): 999.05

- 52 Week High: 67.40

- 52 Week Low: 32.13

- Mkt Cap (Rs. Cr.): 10,403

- Face Value: 10

NMDC Steel Share Price Chart

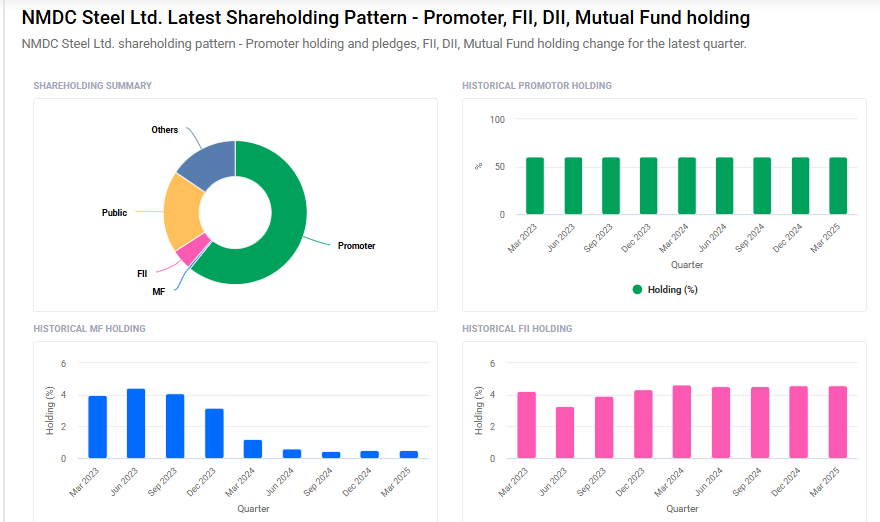

NMDC Steel Shareholding Pattern

- Promoters: 60.8%

- FII: 4.6%

- DII: 16%

- Public: 18.6%

NMDC Steel Share Price Target Tomorrow 2025 To 2030

| NMDC Steel Share Price Target Years | NMDC Steel Share Price |

| 2025 | ₹70 |

| 2026 | ₹900 |

| 2027 | ₹110 |

| 2028 | ₹120 |

| 2029 | ₹140 |

| 2030 | ₹160 |

NMDC Steel Share Price Target 2025

Here are four key factors influencing the growth of NMDC Steel Limited (NSL) and its share price target for 2025:

1. Production Capacity Expansion

NMDC Steel has significantly increased its production capacity, achieving 2 million tonnes of hot metal production in FY25—a 100% rise from the previous year. This expansion enhances the company’s ability to meet growing domestic steel demand and positions it favorably for future growth.

2. Securing Raw Material Supply

India imports approximately 85% of its coking coal, a critical input for steel manufacturing. To mitigate supply risks, NMDC is exploring the acquisition of coking coal assets in Indonesia and Australia. Securing these resources would reduce dependency on imports and stabilize production costs.

3. Government Infrastructure Initiatives

The Indian government’s push to increase steel production capacity to 300 million tonnes by 2030 presents significant opportunities for NMDC Steel. Participation in national infrastructure projects can lead to increased demand for the company’s products, driving revenue growth.

4. Market Position and Valuation

Despite being a relatively new entrant in the steel industry, NMDC Steel is trading at discounted valuations compared to peers. With average financial strength and a low growth trend, the company has room for improvement. Enhancing operational efficiency and capitalizing on market opportunities could positively impact its share price.

NMDC Steel Share Price Target 2030

Here are four key Risks and Challenges that could affect NMDC Steel’s share price target by 2030:

-

Raw Material Dependency

NMDC Steel is heavily reliant on imported coking coal, especially from countries like Australia and Indonesia. Any disruptions in global supply chains or price volatility could significantly raise production costs and impact profit margins. -

Execution and Ramp-up Risks

As a relatively new player in the steel industry, NMDC Steel may face challenges in scaling operations, improving efficiency, and achieving consistent capacity utilization—all of which are crucial for long-term profitability. -

Market Competition and Price Pressure

The Indian steel sector is highly competitive, with major players like Tata Steel, JSW, and SAIL dominating the market. Intense competition could lead to pricing pressure and limit NMDC Steel’s ability to grow its market share. -

Environmental and Regulatory Challenges

Increasing focus on decarbonization and stricter environmental norms may require significant investments in cleaner technologies. These regulations could pose financial and operational challenges if not addressed proactively.

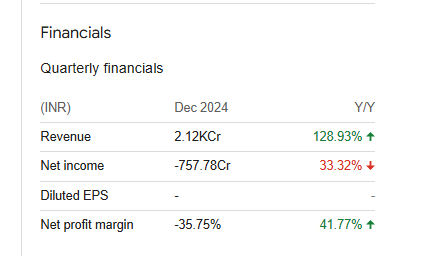

NMDC Steel Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 30.49B | — |

| Operating expense | 11.84B | — |

| Net income | -15.60B | — |

| Net profit margin | -51.17 | — |

| Earnings per share | — | — |

| EBITDA | -14.31B | — |

| Effective tax rate | 29.11% | — |

Read Also:- BHEL Share Price Target Tomorrow 2025 To 2030