Patel Engineering Share Price Target Tomorrow 2025 To 2030

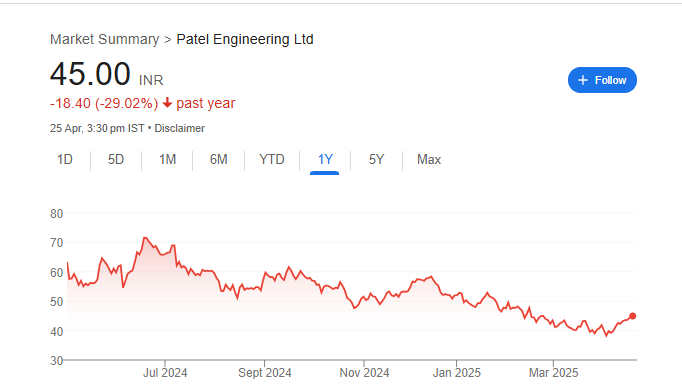

Patel Engineering Limited, established in 1949, is a prominent infrastructure and construction services company based in Mumbai, India. The company specializes in a diverse range of sectors, including hydroelectric projects, dams, tunnels, roads, railways, irrigation systems, and real estate developments such as townships and commercial complexes. Patel Engineering Share Price on NSE as of 28 April 2025 is 45.00 INR.

Patel Engineering Share Market Overview

- Open: 47.24

- High: 48.60

- Low: 44.25

- Previous Close: 44.43

- Volume: 21,015,525

- Value (Lacs): 9,530.54

- 52 Week High: 79.00

- 52 Week Low: 24.20

- Mkt Cap (Rs. Cr.): 3,829

- Face Value: 1

Patel Engineering Share Price Chart

Patel Engineering Shareholding Pattern

- Promoters: 36.1%

- FII: 5%

- DII: 4.7%

- Public: 49.8%

- Others: 4.4%

Patel Engineering Share Price Target Tomorrow 2025 To 2030

| Patel Engineering Share Price Target Years | Patel Engineering Share Price |

| 2025 | ₹80 |

| 2026 | ₹100 |

| 2027 | ₹120 |

| 2028 | ₹140 |

| 2029 | ₹160 |

| 2030 | ₹180 |

Patel Engineering Share Price Target 2025

Here are 4 key factors that could influence the growth of Patel Engineering’s share price by 2025:

1. Robust Order Book and Revenue Visibility

Patel Engineering boasts a strong order book of approximately ₹173 billion as of the first half of FY25, providing nearly four years of revenue visibility. This substantial backlog, especially in hydroelectric and tunneling projects, indicates a healthy pipeline that can drive consistent revenue growth.

2. Stable Operating Margins

The company has maintained stable EBITDA margins in the range of 14% to 15%, supported by its focus on high-margin hydro projects. This consistency in profitability underscores efficient project execution and cost management, which are crucial for sustaining investor confidence.

3. Strategic Debt Reduction Initiatives

Patel Engineering has been actively working to reduce its debt by monetizing non-core assets and resolving arbitration claims. As of H1FY25, it received ₹2.2 billion from arbitration awards, which aids in lowering debt levels and improving financial health.

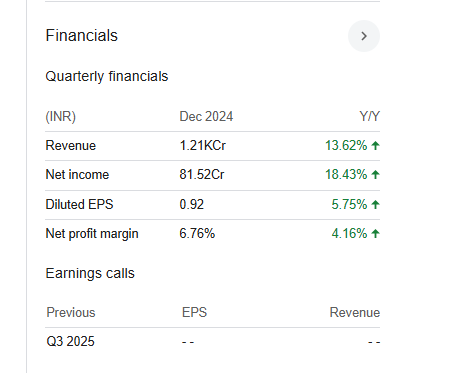

4. Positive Financial Performance

In Q3FY25, the company reported a 13% increase in revenue and a 19% rise in net profit year-over-year. This strong financial performance reflects robust execution capabilities and enhances investor confidence in the company’s growth trajectory.

Patel Engineering Share Price Target 2030

Here are 4 risks and challenges that could impact Patel Engineering’s share price by 2030:

1. Execution Delays in Large-Scale Projects

Patel Engineering’s business depends heavily on the timely execution of large infrastructure projects, particularly in the hydroelectric and tunneling sectors. Any delays in project completion could lead to cost overruns, reduced revenue, and lower profit margins, which would negatively affect investor sentiment and the share price.

2. Regulatory and Environmental Challenges

Patel Engineering is involved in several environmental and regulatory approvals, especially for its infrastructure projects. Changes in environmental regulations or delays in securing necessary permits could halt or slow down projects, impacting revenue growth and stock performance.

3. Fluctuating Raw Material Prices

The cost of raw materials like cement, steel, and other construction materials can significantly affect Patel Engineering’s profitability. Fluctuations in prices due to global supply chain disruptions, inflation, or geopolitical events may lead to higher project costs, squeezing profit margins and affecting share price growth.

4. High Debt Levels and Interest Rate Risks

Despite efforts to reduce debt, Patel Engineering still carries a significant debt load. Any increase in interest rates or failure to effectively manage debt repayments could lead to higher financial costs, reducing profitability and limiting the company’s ability to invest in growth, which could negatively impact share price performance.

Patel Engineering Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 45.44B | 16.78% |

| Operating expense | 6.59B | 17.39% |

| Net income | 2.90B | 58.18% |

| Net profit margin | 6.39 | 35.38% |

| Earnings per share | — | — |

| EBITDA | 6.85B | 23.42% |

| Effective tax rate | 25.51% | — |

Read Also:- Vedanta Share Price Target Tomorrow 2025 To 2030