Radico Khaitan Share Price Target From 2025 to 2030

Radico Khaitan Share Price Target From 2025 to 2030: Involvement in stocks requires attentive reading of a company’s accounts, its position in the market, and scope for expansion in the future. Some of the stocks which have received much attention are Radico Khaitan Ltd.’s shares, being one of the front-runners in Indian liquor sector.

This report provides a detailed analysis of Radico Khaitan Ltd., its recent share price movement, fundamental information, technical analysis, and projected share price targets from 2025 to 2030. At the end of this report, you will be sure whether this stock is a good long-term investment or not.

Company Overview and Market Position

Radico Khaitan Ltd. is a diversified Indian liquor sector major involved in the production and sale of spirits such as whisky, rum, vodka, and gin. The firm has among the highly sought-after brands in its portfolio such as Magic Moments, 8 PM Whisky, and Rampur Indian Single Malt.

Key Market Drivers

- Growing Demand for Alcohol: Growing demand for premium spirits in India and globally.

- Growing Market Share: Brand image strength and product differentiation.

- Government Policies: Favorable policies for liquor distribution and liquor licensing.

- Export Growth: Growth in global reach with premium products.

Keeping these in mind, Radico Khaitan is poised to grow progressively in the alcoholic drinks industry.

Recent Stock Market Performance

Radico Khaitan stocks have displayed high volatility, influenced by market factors and sector trends. Below are its significant performance statistics:

- Current Price: ₹2,351.60

- Market Capitalization: ₹31,712 Cr

- P/E Ratio: 103.13

- Dividend Yield: 0.13%

- 52-Week High: ₹2,637.70

- 52-Week Low: ₹1,429.85

The stock has provided a return of 39.76% over the last one year, and thus it is a suitable investment for long-term investors.

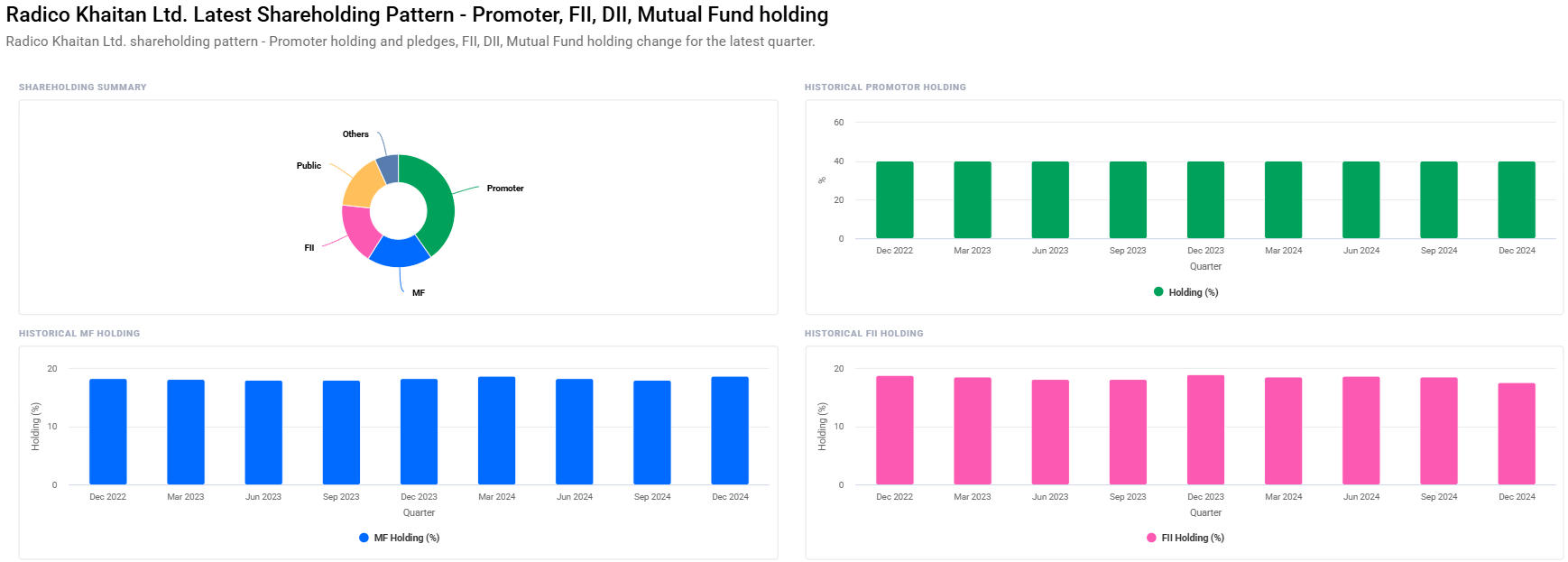

Ownership Structure and Institutional Confidence

The share holding pattern indicates institutional investor and mutual fund confidence:

- Promoters: 40.24% (remained unchanged in the Dec 2024 quarter)

- Foreign Institutions (FII/FPI): 17.72% (decreased by a small margin from 18.60%)

- Mutual Funds: 18.75% (increased from 18.12%)

- Retail & Others: 16.48%

- Other Domestic Institutions: 6.81%

This indicates strong confidence of the promoter and accumulation of institutional interest, and Radico Khaitan is a good long-term bet.

Technical Analysis – Time to Buy?

Technical indicator-based investors, Radico Khaitan stock is moderately strong with bullish signal.

- Momentum Score: 61.5 (Moderately Strong)

- MACD: 56.4 (Bullish Signal)

- ADX: 28.2 (Indicates rising trend)

- RSI (14): 61.1 (Neutral, neither overbought nor oversold)

- MFI: 71.2 (Overbought, expect pullback)

These signs indicate massive potential for long-term growth, but short-term investors need to be cautious about minor corrections.

Radico Khaitan Share Price Target (2025-2030)

Based on technical and fundamental analysis, the following are the forecasted price targets:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹2700 |

| 2026 | ₹4000 |

| 2027 | ₹5300 |

| 2028 | ₹6600 |

| 2029 | ₹8000 |

| 2030 | ₹9400 |

All these forecasts indicate good bullish movement in the next five years, and Radico Khaitan is a multi-bagger stock in the future.

Investment Strategy – Should You Buy?

Short-Term Investors (1-2 Years)

- Risk Level: High

- Strategy: Closely track price action; it is always better to buy during dips.

- Hold Price Target: ₹2,700 (2025)

Medium-Term Investors (3-5 Years)

- Risk Level: Moderate

- Strategy: Buy during dips and hold for long-term appreciation.

- Hold Price Target: ₹5,300-₹6,600 (2027-2028)

Long-Term Investors (5+ Years)

- Risk Level: Low

- Strategy: Buy and hold for long-term yield.

- Hold Price Target: ₹9,400+ (2030)

Risks and Challenges

While the long-term appreciation is big, there are these risks that need to be mindful of:

- Regulatory Issues: Liquor business regulations can influence distribution and pricing.

- Market Volatility: Short-term price volatility owing to macroeconomic factors.

- Competition: Rising competition from international and domestic liquor brands.

- FII Sell-Offs: Share prices can be impacted by foreign institutional investors selling the stocks.

Despite these problems, Radico Khaitan is a good long-term play with a lot of growth potential.

Final Verdict – Good Investment or Not?

Radico Khaitan is a robust liquor company with good finances, brand image, and durable growth drivers. Because of its bullish technical factors and growing institutional belief, the stock will be poised to deliver in the near term.

- Short-term investors: Invest after the pullbacks.

- Medium-term investors: Invest to positionally buy stock.

- Long-term investors: Hold for good returns in the coming 5-7 years.

Radico Khaitan is an ideal stock to create long-term wealth in the Indian stock market in general.

FAQs For Radico Khaitan Share Price

Q1: What will be the target Radico Khaitan share price in 2025?

A: The target price in 2025 would be ₹2,700 if the trend is continued.

Q2: Is Radico Khaitan a good stock to invest in for the long run?

A: It is a growth stock, so it is a reliable bet for long-term players.

Q3: What are the most significant risks for Radico Khaitan?

A: Changes in regulation, market fluctuation, and increase in competition are probable risks.

Q4: How has Radico Khaitan behaved historically?

A: The stock has increased by 39.76% over the last year, which is incredibly robust momentum.

Q5: What is Radico Khaitan’s target price in 2030?

A: The target price of 2030 is put at ₹9,400 based on further growth.

Q6: Should one buy Radico Khaitan now?

A: It may be a good strategy to buy dips if you are a long-term investor.

Q7: What will trigger growth for Radico Khaitan?

A: Globalization, higher liquor consumption, and healthy finances will be the driving forces.

Weighing opportunities against threats, Radico Khaitan appears to be a sure shot in the times to come.