Samhi Hotels Share Price Target Tomorrow 2025 To 2030

Samhi Hotels Limited is a prominent hotel ownership and asset management company in India, headquartered in Gurugram. Established in 2010, the company has developed a diverse portfolio of 32 operating hotels, encompassing approximately 4,943 rooms, across 13 major cities including Delhi, Bengaluru, Hyderabad, Chennai, and Pune . Samhi Hotels partners with renowned global hotel brands such as Marriott, Hyatt, and IHG, operating properties under well-known names like Courtyard by Marriott, Sheraton, Hyatt Regency, and Holiday Inn Express . The company’s strategy focuses on acquiring and revitalizing hotel assets, leveraging the expertise and brand recognition of its partners to enhance guest experiences. Samhi Hotels Share Price on BOM as of 17 April 2025 is 176.40 INR.

Samhi Hotels Share Market Overview

- Open: 176.37

- High: 182.20

- Low: 175.79

- Previous Close: 176.37

- Volume: 1,468,063

- Value (Lacs): 2,589.37

- VWAP: 179.01

- UC Limit: 211.64

- LC Limit: 141.09

- 52 Week High: 225.48

- 52 Week Low: 121.10

- Mkt Cap (Rs. Cr.): 3,901

- Face Value: 1

Samhi Hotels Share Price Chart

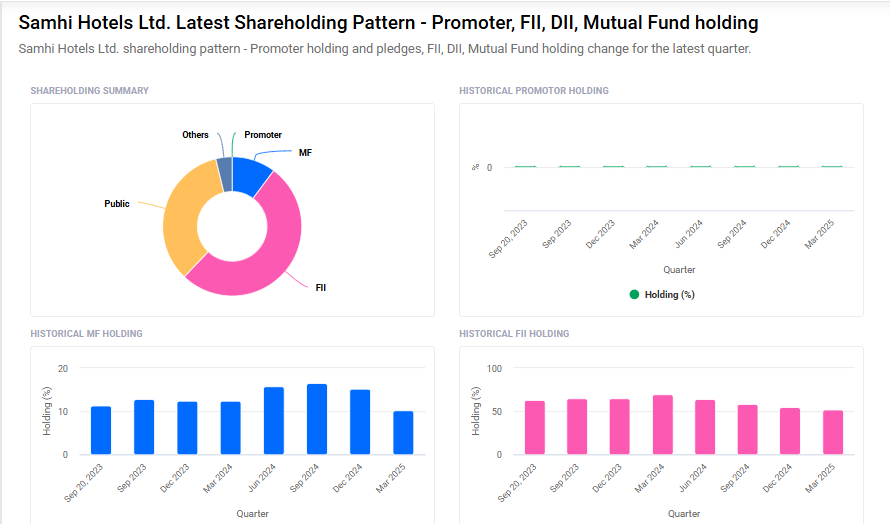

Samhi Hotels Shareholding Pattern

- Promoters: 0%

- FII: 51.9%

- DII: 14%

- Public: 34.1%

Samhi Hotels Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹230

- 2026 – ₹260

- 2027 – ₹290

- 2028 – ₹320

- 2030 – ₹350

Major Factors Affecting Samhi Hotels Share Price

Here are 6 Factors Affecting Samhi Hotels Share Price:

-

Tourism and Travel Trends

Samhi Hotels’ business depends largely on how many people are traveling for work or leisure. If more people are booking hotels due to rising tourism or business trips, the company earns more, which can push the share price higher. But during travel slowdowns, like during pandemics or economic troubles, revenues can drop, which may bring the share price down. -

Hotel Occupancy and Room Rates

The share price is also influenced by how many rooms the hotel is able to fill and the average rate it charges per room. Higher occupancy and better room rates lead to increased profits, which investors usually see as a good sign. If these numbers fall, the stock may be affected negatively. -

Company’s Financial Health

The financial performance of Samhi Hotels — including revenue, profit margins, and debt levels — plays a big role in how the share price moves. A strong balance sheet with good earnings attracts more investors and builds trust, while weak financials can lead to a drop in the stock price. -

Expansion Plans and New Properties

When Samhi Hotels opens new hotels or enters new cities, it shows growth and future potential. This often excites investors, leading to a rise in share price. However, if new projects are delayed or don’t perform well, it may raise concerns and affect the stock negatively. -

Brand Partnerships and Management Contracts

Samhi Hotels often operates through partnerships with global hotel brands. Strong partnerships with trusted names like Marriott or Hyatt can help attract more guests and boost earnings. Positive news about such collaborations can improve investor sentiment and increase the share value. -

General Market Sentiment and Economic Conditions

Like all stocks, Samhi Hotels is also affected by how the overall stock market and economy are doing. If the market is positive and investors are confident in the hospitality sector, the share price may rise. In contrast, during economic uncertainty or stock market corrections, the price may go down—even if the company itself is doing fine.

Risks and Challenges for Samhi Hotels Share Price

Here are 6 Risks and Challenges for Samhi Hotels Share Price:

-

Seasonal and Travel Fluctuations

The hospitality industry is highly seasonal. During holidays or tourist seasons, hotels usually perform well, but in off-seasons or during bad weather, bookings may fall. If Samhi Hotels experiences low occupancy during quiet periods, it can affect revenue and may lead to a drop in its share price. -

Dependence on Business Travel and Tourism

A large part of Samhi Hotels’ income comes from travelers—both business and leisure. Any event that reduces travel, like economic slowdown, pandemics, or geopolitical tensions, can cause fewer bookings. This drop in demand can hurt earnings and bring down the stock price. -

Rising Operating Costs

Running hotels comes with many costs—like staff salaries, maintenance, electricity, and supplies. If these costs rise and the company is unable to raise room prices, profits may shrink. Lower profits can worry investors and negatively impact the share price. -

High Competition in the Hotel Industry

Samhi Hotels faces strong competition from other hotel chains and online platforms like Airbnb. If competitors offer better services, lower prices, or more attractive locations, Samhi may lose customers. This can reduce revenue and place pressure on its market value. -

Debt Levels and Financial Risks

If the company has a lot of debt or high interest payments, it can be a challenge during times of low earnings. Investors often look at how well a company manages its debt. If the debt seems risky or too high, it may reduce investor confidence and hurt the share price. -

Uncertain Economic Conditions

Economic slowdowns, inflation, or rising interest rates can affect people’s spending habits. In tough times, travel and hotel stays are often the first things people cut back on. Such situations can impact Samhi Hotels’ business and lead to a fall in its stock price.

Read Also:- Shah Metacorp Share Price Target Tomorrow 2025 To 2030