Senores Pharmaceuticals Share Price Target Tomorrow 2025 To 2030

Senores Pharmaceuticals Limited is a research-driven pharmaceutical company based in Ahmedabad, India, established in 2017. The company specializes in developing and manufacturing a wide range of generic pharmaceutical products, focusing on complex and specialty formulations. With a strong presence in regulated markets such as the United States, Canada, and the United Kingdom, Senores also extends its reach to emerging markets across 43 countries. Senores Pharmaceuticals Share Price on NSE as of 8 May 2025 is 493.50 INR.

Senores Pharmaceuticals Share Market Overview

- Open: 488.00

- High: 499.90

- Low: 481.10

- Previous Close: 495.00

- Volume: 196,787

- Value (Lacs): 974.29

- 52 Week High: 665.00

- 52 Week Low: 435.25

- Mkt Cap (Rs. Cr.): 2,280

- Face Value: 10

Senores Pharmaceuticals Share Price Chart

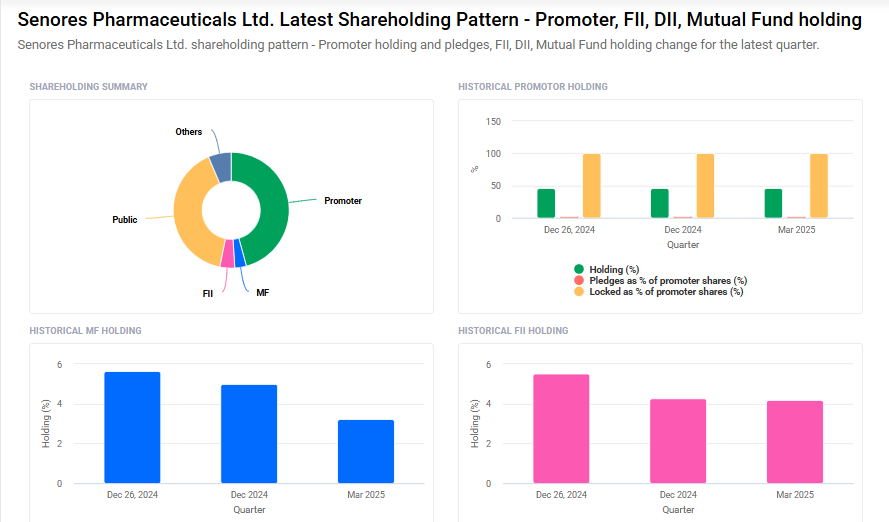

Senores Pharmaceuticals Shareholding Pattern

- Promoters: 45.8%

- FII: 4.2%

- DII: 9.7%

- Public: 40.4%

Senores Pharmaceuticals Share Price Target Tomorrow 2025 To 2030

| Senores Pharmaceuticals Share Price Target Years | Senores Pharmaceuticals Share Price |

| 2025 | ₹670 |

| 2026 | ₹720 |

| 2027 | ₹770 |

| 2028 | ₹820 |

| 2029 | ₹870 |

| 2030 | ₹920 |

Senores Pharmaceuticals Share Price Target 2025

Senores Pharmaceuticals share price target 2025 Expected target could ₹670. Here are four key factors that could influence Senores Pharmaceuticals’ share price target by 2025:

1. Robust Financial Growth

Between FY22 and FY24, Senores Pharmaceuticals experienced significant growth, with revenue increasing from ₹14 crore to ₹215 crore and profit after tax rising from ₹1 crore to ₹33 crore. This impressive performance reflects the company’s effective strategies and market expansion efforts.

2. Expansion in Regulated and Emerging Markets

The company operates in over 45 countries, including regulated markets like the US and Europe, which contributed to 61% of its total revenue in H1 FY25. Additionally, its presence in emerging markets has grown substantially, with revenue increasing more than tenfold in 9MFY25 compared to the previous year.

3. Strategic Partnerships and Product Portfolio Expansion

Senores has established long-term partnerships with major pharmaceutical companies such as Sun Pharma, Dr. Reddy’s, and Alkem Laboratories. These collaborations have enhanced its product portfolio and market reach, particularly in regulated markets.

4. Investment in Research and Development

With three R&D facilities in India and the US, Senores is committed to developing complex generics and expanding its product offerings. The company has received approvals for 24 Abbreviated New Drug Applications (ANDAs) and is actively working on additional filings, positioning itself for sustained growth.

Senores Pharmaceuticals Share Price Target 2030

Senores Pharmaceuticals share price target 2030 Expected target could ₹920. Here are four key Risks and Challenges that could impact Senores Pharmaceuticals’ share price target by 2030:

1. Regulatory Scrutiny and Compliance Risks

Senores Pharmaceuticals operates in highly regulated markets, including the U.S. and Europe. Any lapses in compliance with regulatory standards, such as those set by the U.S. FDA, can lead to warnings, product recalls, or facility shutdowns. For instance, the company’s U.S.-based facility underwent scrutiny from the FDA in 2022, which could have impacted its operations and financials . Such regulatory challenges can adversely affect the company’s reputation and financial performance.

2. High Dependence on Third-Party Partnerships

A significant portion of Senores Pharmaceuticals’ revenue is generated through third-party marketing partners and distributors. The loss of one or more of these partners, or any deterioration in their financial condition, could negatively impact the company’s sales and profitability . This dependency poses a risk to the company’s business continuity and growth prospects.

3. Negative Cash Flows and Working Capital Challenges

The company has reported negative cash flows from operating activities in recent fiscal years, primarily due to higher working capital requirements as operations scaled up . Continued negative cash flows can strain the company’s financial resources, affecting its ability to invest in growth opportunities and meet operational needs.

4. Intense Competition in the Generic Pharmaceuticals Market

Senores Pharmaceuticals operates in the generic medicines industry, which is characterized by low entry barriers and intense competition. The presence of numerous organized players can lead to price wars and reduced profit margins. Additionally, the lack of client stickiness in the generic segment makes it challenging to maintain long-term customer relationships.

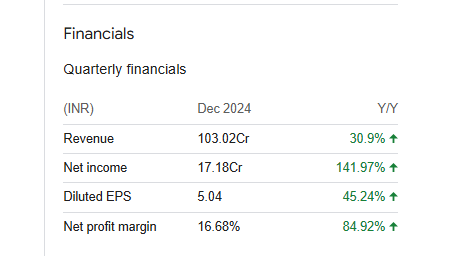

Senores Pharmaceuticals Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 2.15B | 507.08% |

| Operating expense | 740.63M | 535.90% |

| Net income | 314.55M | 273.00% |

| Net profit margin | 14.66 | -38.56% |

| Earnings per share | — | — |

| EBITDA | 379.72M | 246.62% |

| Effective tax rate | -31.13% | — |

Read Also:- Accent Microcell Share Price Target Tomorrow 2025 To 2030