Sonata Software Share Price Target Tomorrow 2025 To 2030

Sonata Software is a global technology company headquartered in Bengaluru, India, specializing in digital transformation and IT services. Established in 1986, it has grown to serve clients across North America, Europe, Asia-Pacific, and the Middle East. The company offers a range of services, including cloud and data modernization, enterprise application services, and digital contact center solutions. Sonata’s proprietary Platformation™ approach combines industry expertise with platform technology to deliver tailored solutions for businesses. Sonata Software Share Price on NSE as of 8 May 2025 is 396.30 INR.

Sonata Software Share Market Overview

- Open: 385.30

- High: 406.90

- Low: 371.35

- Previous Close: 385.30

- Volume: 15,475,979

- Value (Lacs): 61,470.59

- 52 Week High: 763.70

- 52 Week Low: 286.40

- Mkt Cap (Rs. Cr.): 11,138

- Face Value: 1

Sonata Software Share Price Chart

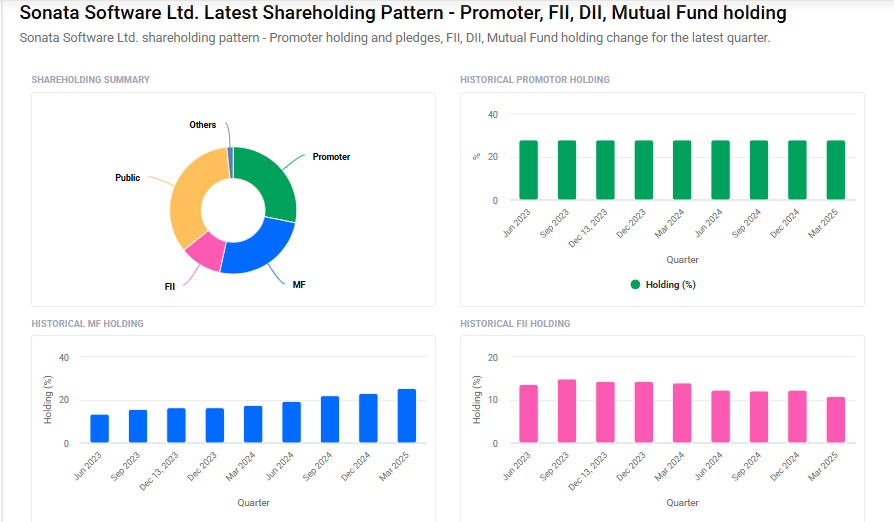

Sonata Software Shareholding Pattern

- Promoters: 28.2%

- FII: 10.8%

- DII: 25.9%

- Public: 24.2%

Sonata Software Share Price Target Tomorrow 2025 To 2030

| Sonata Software Share Price Target Years | Sonata Software Share Price |

| 2025 | ₹770 |

| 2026 | ₹900 |

| 2027 | ₹0100 |

| 2028 | ₹1100 |

| 2029 | ₹1200 |

| 2030 | ₹1300 |

Sonata Software Share Price Target 2025

Sonata Software share price target 2025 Expected target could ₹770. Here are four key factors that could influence Sonata Software’s share price target by 2025:

1. Strategic Focus on AI and Cloud Services

Sonata Software is intensifying its investments in artificial intelligence (AI) and cloud computing. The company aims to derive 20% of its revenue from AI-enabled services by FY27, with a current AI pipeline valued at USD 67 million. Additionally, the cloud and data pipeline now constitute over 50% of the overall pipeline, a significant increase from 15% two years ago.

2. Expansion in Key Verticals and Geographies

The U.S. market contributes 72% of Sonata’s revenue, reflecting a 17.2% year-over-year increase. The company has also seen growth in the TMT (33.1% YoY) and BFSI (17.6% YoY) verticals. Strategic acquisitions, such as that of Quant Systems Inc., have bolstered capabilities and expanded the company’s footprint in North America.

3. Robust Deal Pipeline and Strategic Partnerships

Sonata secured three substantial deals recently, including data modernization for a leading U.S. financial institution and cloud services for a prominent technology company. The company also signed a five-year joint go-to-market agreement with Zones to simplify enterprise applications, aiming to support cost efficiency and data optimization through joint offerings.

4. Strong Financial Performance and Institutional Confidence

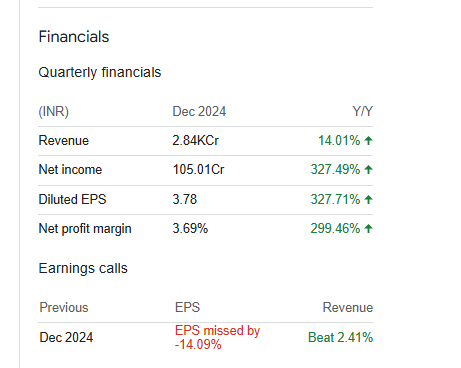

In Q3 FY25, Sonata reported consolidated revenues of ₹2,842.8 crore, a 31% quarter-over-quarter increase. The company’s EBITDA margin stood at 22.6%, indicating resilient performance. Promoters hold a 28.17% stake, while Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) collectively own 36.59%, reflecting strong institutional confidence.

Sonata Software Share Price Target 2030

Sonata Software share price target 2030 Expected target could ₹1300. Here are four key risks and challenges that could impact Sonata Software’s share price target by 2030:

1. High Client Concentration Risk

Sonata Software’s revenue is heavily reliant on a few major clients. Recent reports indicate that the company faced revenue setbacks due to issues with its largest international client, leading to a significant drop in share price. Such dependency makes the company vulnerable to fluctuations in client relationships and can adversely affect financial stability.

2. Margin Pressures and Growth Slowdown

Analysts have expressed concerns over declining margins and specific account-related challenges affecting Sonata’s financial performance. Despite securing new deals, the company’s International IT Services segment is experiencing a slowdown, raising questions about its ambitious revenue targets for FY27.

3. Climate-Related Transition Risks

Sonata’s own climate risk assessment has identified ten significant transition risks that could impact its operations by 2030. These include regulatory changes, shifts in market preferences, and technological advancements related to climate change. Failure to adapt to these evolving factors may pose challenges to the company’s long-term sustainability.

4. Market Volatility and Investor Sentiment

The company’s stock has experienced considerable volatility, with a nearly 50% decline in 2025 alone. Such fluctuations, driven by weak guidance and client-related issues, can erode investor confidence and make it challenging for Sonata to maintain a stable market valuation.

Sonata Software Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 86.13B | 15.63% |

| Operating expense | 8.05B | 58.71% |

| Net income | 3.09B | -31.73% |

| Net profit margin | 3.58 | -41.02% |

| Earnings per share | 15.30 | -6.07% |

| EBITDA | 7.54B | 29.67% |

| Effective tax rate | 33.14% | — |

Read Also:- Coffee Day Share Price Target Tomorrow 2025 To 2030