Swaraj Engines Share Price Target From 2025 to 2030

Swaraj Engines Share Price Target From 2025 to 2030: Investing in stocks requires a total understanding of the financials, technicals, and industry status of a company. One stock that has also gained popularity with long-term investors is Swaraj Engines Ltd. (SEL). Renowned for manufacturing high-performance engines for diesel tractors, Swaraj Engines has seen a strong uptrend during the past several years with strong fundamentals and rising demand from agriculture and rural infrastructure sectors.

Here, we would discuss Swaraj Engines share price prediction from 2025 to 2030 with respect to recent performance, financial data, technical strength, and capability to yield returns for extended periods. Ownership pattern, institutional perceptions, as well as constant uncertainties, we deal with by questioning below under FAQs.

Overview: Company Details for Swaraj Engines Ltd.

Swaraj Engines Ltd., being a joint venture firm of Kirloskar Industries and Mahindra & Mahindra, is one of the strongest propelling forces behind India’s farm economy. The firm primarily manufactures diesel engines and engine parts for tractors with the brand name “Swaraj” commonly used by farmers in India.

Key Strengths:

- Zero-debt Company: With Debt-to-Equity of 0.00, the firm has no debts and is self-funded.

- High Return on Equity (ROE): 43.26% indicates efficient use of shareholders’ funds.

- Strong Dividend Yield: 2.40% return on stock offers stable passive income.

- Promoter Stability: Promoters hold 52.12% with no change in the last quarter, indicating holding for long terms.

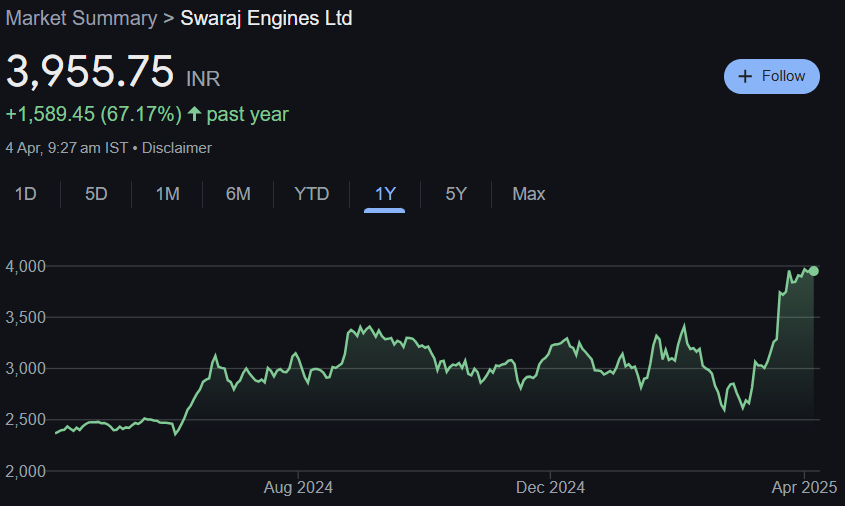

Recent Stock Market Performance

Swaraj Engines has experienced spectacular growth in stock price over the last one year. Following are key highlights of its market numbers:

- Current Price: ₹3,955.75

- 52-Week High: ₹4,200.05

- 52-Week Low: ₹2,266.00

- Market Cap: ₹4,813 Cr

- P/E Ratio (TTM): 30.90

- Book Value: ₹281.43

- EPS (TTM): ₹128.21

- P/B Ratio: 14.08

- Dividend Yield: 2.40%

Yearly Growth:

The stock has gained 67.17% over the last 12 months, reflecting good investor demand and business performance.

Technical Analysis – Momentum and Indicators

- Momentum Score: 67.5 – Indicates the stock being technically moderately strong.

Key Indicators:

- MACD (12,26,9): 265.4 – Bullish signal as it is above center and signal line.

- RSI (14): 74.0 – Overbought zone, expect short-term correction.

- MFI (Money Flow Index): 80.2 – Highly overbought, it can correct at any moment now.

- ADX: 41.3 – Strong trend confirmed.

- ROC (21 Days): 47.2 – Momentum is on the rise.

- ATR (Average True Range): 176.1 – Unusual volatility expected.

- ROC (125 Days): 25.6 – Medium term strength persists.

Meaning: Although the stock is in stage of uptrend, overbuying indicators show possibility of short-term correction. But medium to long-term momentum remains bullish.

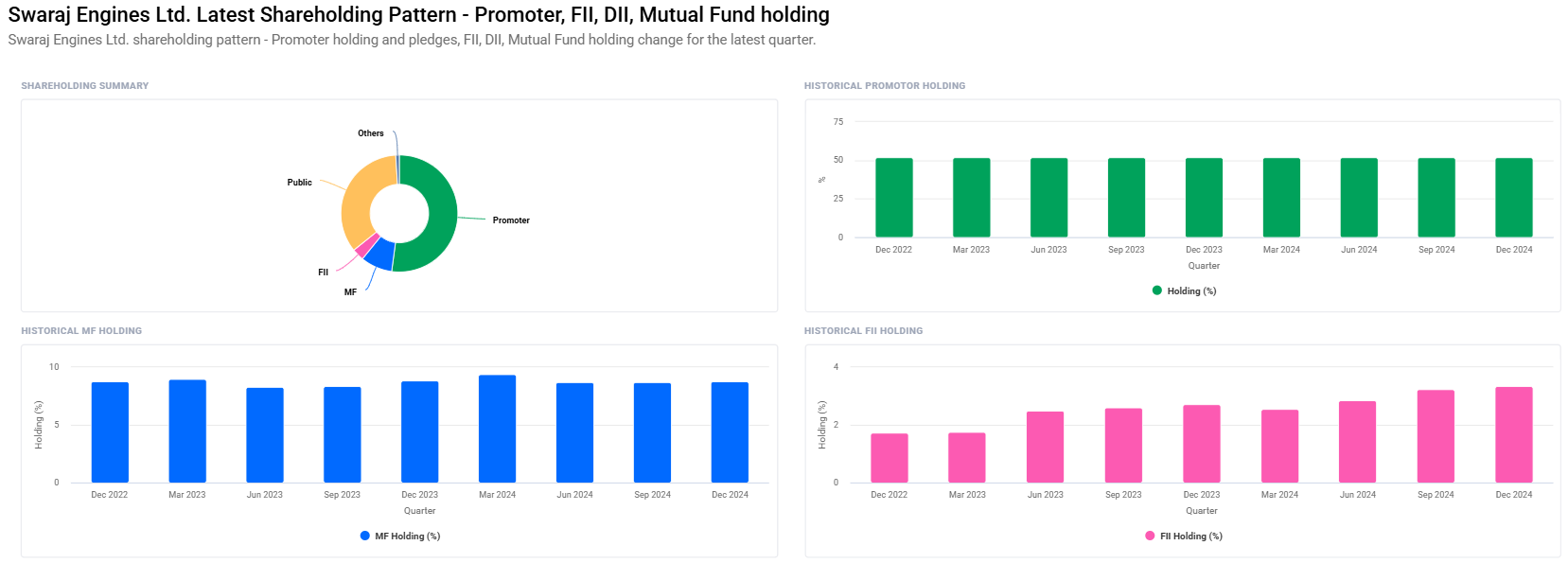

Ownership and Institutional Confidence

- Promoters: 52.12% – Comfort holding.

- Retail & Others: 34.76%

- Mutual Funds: Increased from 8.73% to 8.77%

- FII/FPI: Increased from 3.23% to 3.35%

- Institutional Investors: Increased from 12.94% to 13.12%

This increase in institutional and mutual fund holding reflects high expectations for Swaraj Engines’ future performance. The increase in the number of FII and MF schemes also reflects heightened institutional interest.

Swaraj Engines Share Price Target (2025 to 2030)

After a combination of underlying growth, institutional demand, history, and technicals, a year-by-year prediction is as follows:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹4200 |

| 2026 | ₹6200 |

| 2027 | ₹8200 |

| 2028 | ₹10200 |

| 2029 | ₹12200 |

| 2030 | ₹14200 |

These projections are built on the basis of persistent market momentum, rural demand, and strategic expansion by the company.

Investment Strategy for Different Investor Types

1. Short-Term Traders (1–2 Years)

- Risk Level: Moderate to High

- Strategy: Look for dips during overbought corrections (RSI >70), re-enter at ₹3,600–₹3,800 levels.

- Target: ₹4,200 in 2025

2. Medium-Term Investors (3–5 Years)

- Risk Level: Moderate

- Strategy: Build-up during consolidation phases, SIP-based strategy of choice.

- Target: ₹8,200 by 2027

3. Long-Term Investors (5+ Years)

- Risk Level: Low

- Strategy: Buy and hold, reinvest dividends.

- Target: ₹14,200 by 2030

Risks and Concerns

Despite such strong growth, investors should be wary of:

- Overbought Technical Indicators: There are chances of short-term setbacks.

- Dependence on Farm Sector: Agriculture policies and climatic conditions determine revenues.

- Cost of Inputs Volatility: Inflation in the prices of steel and other raw materials can have a negative effect on margins.

- Global Market Volatility: FIIs can withdraw money during periods of global volatility.

Last Word – Is Swaraj Engines a Good Investment?

Swaraj Engines Ltd. is debt-free with strong fundamentals base, consistent dividend policy, high Return on Equity, and clear path of growth. The growing interest of mutual funds and foreign investors is an indicator of growing faith in its future and business model.

Short-term volatility cannot be prevented due to technical overbought levels, but long-term investors can definitely look at Swaraj Engines as a brilliant wealth creation tale by 2030.

The company’s stable dividend yield, no debt burden, and industry leadership position make it a low-risk, high-reward stock for long-term investment.

FAQ – Swaraj Engines Share Price Target

Q1: Is the company debt-free?

A: Yes, its debt-to-equity is 0.00, which is fully debt-free.

Q2: What is the dividend yield of Swaraj Engines Ltd.?

A: Existing dividend yield of 2.40% ensures passive income benefits to the shareholders.

Q3: Why RSI is overbought? Am I worried?

A: RSI 74 indicates temporary levels of being overbought, and it may induce minute correction. However, it affects long-term growth prospects negatively.

Q4: Long term target of Swaraj Engines share is what?

A: As per continued expectations, share price will touch ₹14,200 up to 2030.

Q5: Is Swaraj Engines a suitable pick for long-term investment?

A: Yes, due to good fundamentals, no debt, and stable promoter and institutional thoughts, it is most suitable to earn long-term wealth.

Q6: Where are the growth in Swaraj Engines led?

A: Primarily the farm economy, tractor production, rural infra, and mechanical farming.

Q7: Do institutional demand increases recently?

A: FII investment and mutual fund holding have increased in the December 2024 quarter.

Q8: What is the P/E ratio of Swaraj Engines?

A: Trailing P/E is 30.90, which is healthy compared to the industry average of 44.12.