Syncom Formulations Share Price Target From 2025 to 2030

Syncom Formulations Share Price Target From 2025 to 2030: Purchasing shares in the shares market is not a question of looking at share prices every day-it requires a lot more than that to know whether a company is financially stable, has good growth prospects, technical signals, and sentiment opinion. One such share which recently woke up and took notice is Syncom Formulations (India) Ltd., a highly popular name in the pharma and nutraceutical industry.

As the Indian pharma sector has been growing strongly with mounting demand for affordable healthcare, rising opportunities for exports, and pro-policy efforts, Syncom Formulations also stands to gain from these phenomena. The article offers detailed analysis of Syncom Formulations’ fundamentals, technicals, market forces, and share price targets for the period 2025-2030.

Company Overview and Market Position

Syncom Formulations (India) Ltd. is engaged in the business of formulation and marketing of pharmaceutical and nutraceutical formulations for the domestic and international markets. With affordability, quality, and innovation in mind, the company has become a brand with a diversified product portfolio that comprises antibiotics, antacids, and analgesics, along with health supplements.

Strengths of Syncom Formulations:

- Affordable product portfolio with focus on mass markets.

- Lowest debt burden adding to financial muscle.

- Presence in overseas markets, particularly in the emerging markets.

- Technically efficient production facilities with international levels of quality standards.

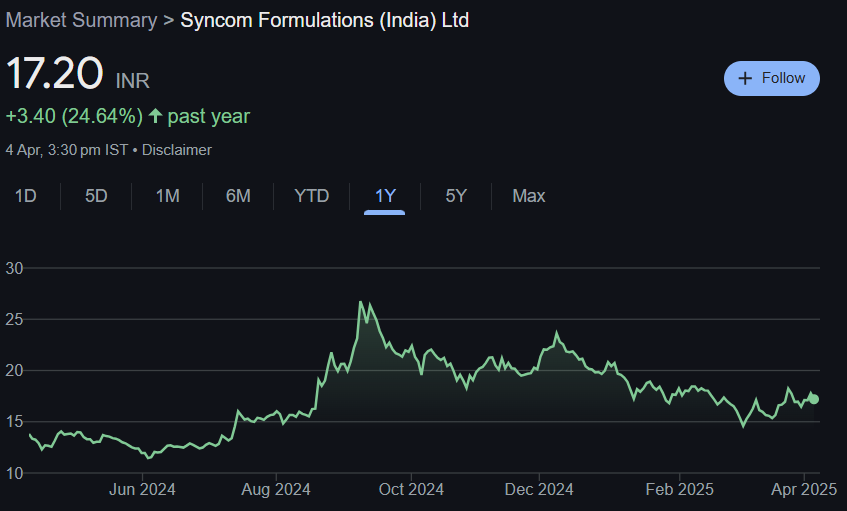

Price Performance over the last one year

Syncom Formulations has also seen moderate price fluctuation over the past one year. While the stock is far lower than its 52-week high, long-term investors are looking at this as a possible value bet.

Key Numbers:

- Current Price: ₹17.20

- 52-Week High: ₹27.90

- 52-Week Low: ₹10.95

- Market Capitalization: ₹1,620 Crores

- P/E Ratio (TTM): 40.88 (above industry average of 33.02)

- EPS (TTM): ₹0.42

- Book Value: ₹3.34

- Dividend Yield: 0.00%

- Debt-to-Equity Ratio: 0.05 (very low and positive)

- Return on Capital Employed (ROCE): 10.57%

Stock has risen 24.64% in one year, indicating increased investor demand.

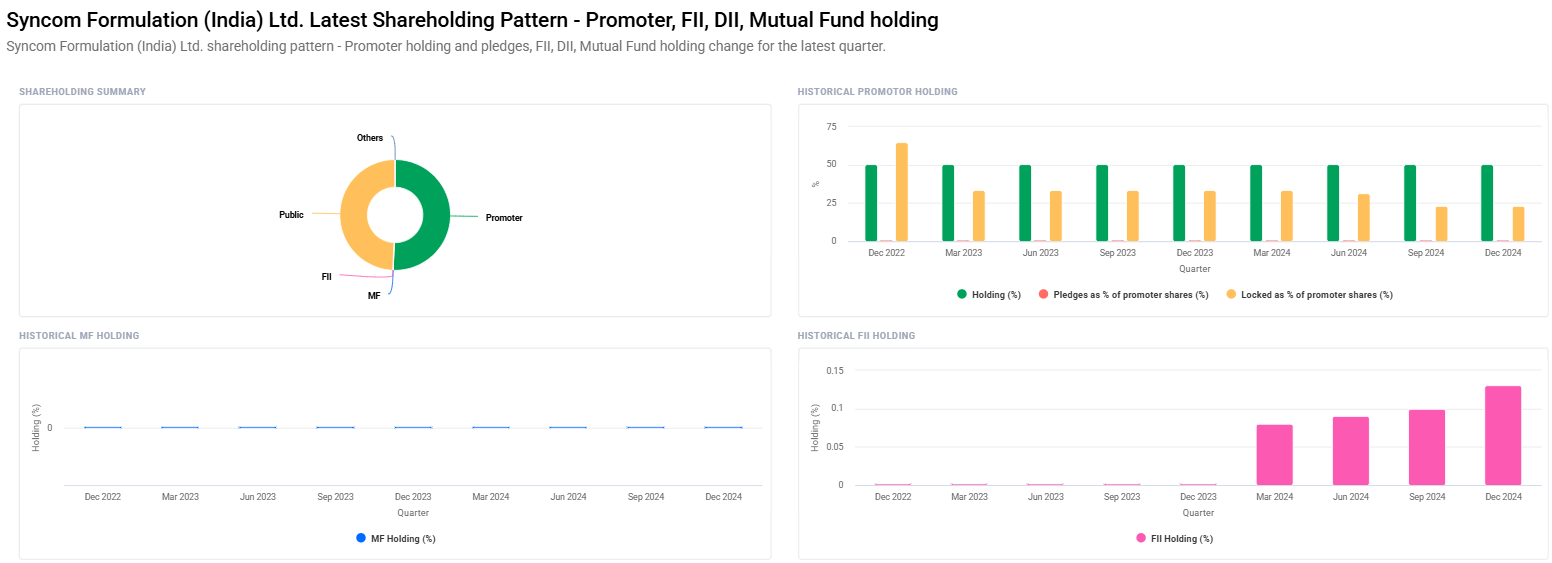

Ownership Pattern and Institutional Perception

Institutional and promoter shareholding in the company is extremely indicative of investor sentiment.

Shareholding Pattern:

- Promoters: 50.57% (no change)

- Foreign Institutional Investors (FII/FPI): Improved from 0.10% to 0.13%

- Number of FII/FPI investors: Improved from 5 to 9

- Mutual Fund Holdings: 0.00% (no change)

- Institutional Investors Overall: Improved from 0.10% to 0.13%

Increased foreign institutional investment is a positive sign, given the company’s small-cap status.

Technical Analysis – What do the Indicators Say?

Syncom Formulations has a neutral to moderately bullish technical chart, according to its current momentum and trend indicators.

Daily Technical Indicators:

- Momentum Score: 50.13 (Neutral)

- MACD: 0.1 (Bullish – MACD line above center and signal lines)

- RSI (14): 52.1 (Neutral – neither oversold nor overbought)

- ADX: 18.3 (Weak trend)

- ROC (21): 12.6 (Positive short-term momentum)

- ROC (125): -17.7 (Negative long-term momentum)

- MFI (Money Flow Index): 59.5 (Moving towards the overbought area)

- ATR (Average True Range): 0.91 (Good volatility)

Interpretation:

- Short-term momentum is increasing but not yet in a trend.

- Strength in short term can be inferred from positive short-term ROC and bullish MACD.

- RSI and MFI suggest the stock to not be overbought, so there is scope for further uptrend.

- Weakening ADX suggests no dominant trend and therefore consolidation or gentle upward drift is the rule.

Industry vs. Fundamentals Pairs

- Syncom P/E Ratio (40.88) is higher than the industry average (33.02), and that speaks of the long-term growth the investor is looking for.

- Company’s Debt-to-Equity ratio is at 0.05, which is a testament to healthy finance.

- Book Value of ₹3.34 comes out, showcasing the stock being premium rather than overly valued for a small-cap pharma firm looking for growth.

Syncom Formulations Share Price Target within 2025-2030 time period

With regard to past performance, technical power, promoter sentiment, and sector expansion potential, ensuing share price goals may be envisaged as:

Year\tTarget Price (INR)\tTreason

2025 ₹30 Improved earnings visibility, robust investor appetite, and positive MACD momentum

2026 ₹50 Enhanced market share, higher export sales, and possible capacity additions

2027 ₹70 Preserved EPS growth and operating scalability

2028 ₹90 Penetration in new therapeutic classes or overseas approvals can lead to re-rating

2029 ₹110 Fleeted top-line stream, resilient operating margin, and increased institutional holding

2030 ₹130 Mature phase business with stable returns with leadership in domestic & transformational pharma business

Investment Plan for Diversified Investors

Short-Term Investors (1-2 Years)

- Strategy: Pick momentum oscillators such as MACD & RSI.

- Risk Level: Moderate

- Target: ₹30 to ₹50

- Action: Wait for the entry at ₹17-18 and stage profits after ₹30

Medium-Term Investors (3-5 Years)

- Strategy: Buy on a decline and hold during consolidation phases.

- Risk Level: Low to medium

- Target: ₹70 to ₹90

- Action: Apply SIP strategy or stage investments

Long-Term Investors (5+ Years)

- Strategy: Hold for the advantage of compounding and sectoral tailwinds.

- Risk Level: Low

- Target: ₹110 to ₹130

- Action: Most appropriate for patient risk investors who can hold on to fetch multi-bagger returns

Risks and Concerns to Bear in Mind

Even though the future appears to be rosy, there are certain things which investors must bear in mind:

- Low Institutional Interest: Liquidity can get dissipated at short-term with low FII and mutual fund presence.

- Small-Cap Volatility: The stock will remain very volatile with unstable price action.

- No Dividend Yield: Does not pay dividend to existing investors.

- P/E Valuation: Highly valued on an earnings basis; requires stable performance to sustain the valuation.

- Limited Analyst Coverage: Small-cap firms receive little coverage, which impacts price discovery.

Syncom Formulations is a strong investment story among small-cap pharma. It reflects signs of good fundamentals, low leverage, positive investors’ sentiment, and technically positive trends. The rise in foreign investor holding, spurred by good fundamentals and earnings expectations, makes Syncom a long-term investor’s watch stock. Short-term speculators, however, would need to monitor technical breakouts near support levels (₹20.50).

As the company enjoys a good run and taps export opportunities or new products, it may return multiple times by 2030.

Frequently Asked Questions (FAQs)

1. What would be the approximate share price of Syncom Formulations in 2025?

Syncom Formulations’ share price would be around ₹30 by 2025, subject to positive momentum and robust financial numbers.

2. Is Syncom Formulations a good long-term investment?

Yes, owing to its minimal debt exposure, robust promoter holding, and expanding presence in the pharma space, Syncom is an excellent stock to derive value from in the longer term.

3. What are Syncom Formulations’ main investment risks?

The main risks are volatility of small cap, high valuation multiple to earnings, absence of dividend yield, and relatively low institutional holding.

4. What technical indicators show a bull trend in Syncom?

Technical indicators like MACD, ROC (21), and RSI are in the neutral to bullish range, showing short-term potential for a move upwards.

5. Why does Syncom Formulations have no dividend yield?

The business is now channeling profits on business growth and operations, and this is usually the case for small-cap business growth companies.

6. Syncom Formulations’ shareholding pattern is like this:

The promoters own 50.57%, and the institutions are little higher at 0.13%. Mutual funds are not in play.

Syncom Formulations is an appropriate pharma stock to expand exponentially in the next five years. Since entry can be made with patience and risk aversion, the stock can yield good returns by 2030 to the volatility bear investors seeking long-term returns.