Tamboli Industries Share Price Target From 2025 to 2030

Tamboli Industries Share Price Target From 2025 to 2030: Stock market investment demands in-depth study of a company’s fundamentals, technicals, and future growth opportunities. One such company that has been overlooked in becoming increasingly popular among small-cap investors is Tamboli Industries Ltd. Though the company has a small market capitalization of ₹138.19 crore, the company can be termed an unknown name in the market, but its consistent business model and special technical signals make it a watch stock.

In this article, we will give a thorough analysis of Tamboli Industries, from its market performance to its ownership, technical outlook, and most crucially, its share price targets from 2025 to 2030. This through analysis will help you decide if you should or shouldn’t include Tamboli Industries in your portfolio.

Company Overview and Market Position

Tamboli Industries Ltd. is involved in investment operations and is a holding company that assists its subsidiaries in performing precision manufacturing. Although not a conventional industrial conglomerate, its strength is in providing stable returns and efficiently managing its capital.

While the company’s core business is not a consumer or manufacturing-related business in a direct sense, its long-term equity investments and shareholding in successful subsidiaries offer a reliable source of return and upside.

Core Strengths:

- Agile holding company: Effective capital management in its holdings.

- Streamlined organization: Minimal debt, lower operating complexity.

- Consistent performance: Steers clear of risky ventures with solid business returns.

- In growing investor interest: Demand has been increasing in terms of recent buy/sell trades.

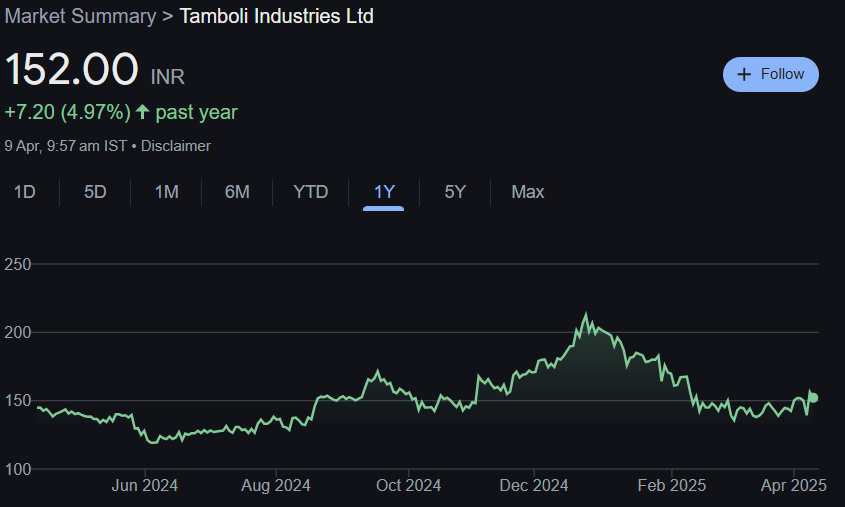

Recent Market Performance

The scrip has seen both the highs and lows in the recent past, a reflection of investor mood in the field of small caps. Let us take a look at the important numbers:

- Open: ₹156.20

- Day High/Low: ₹156.20 / ₹152.00

- 52-week High: ₹215.00

- 52-week Low: ₹110.00

- Market Cap: ₹138.19 crore

- P/E Ratio: Not available (suggests volatility in earnings or recent loss)

- Dividend Yield: Not available (possibly a reinvestment strategy or at infancy stage)

- Current Price Trend: ₹152.00 (+4.97% YoY)

The stock has moved up +7.20 INR in the last one year, showing resilience against macro pressure. Its volume, though tiny (210 shares on last trading day), depicts consistent interest in a closely held stock.

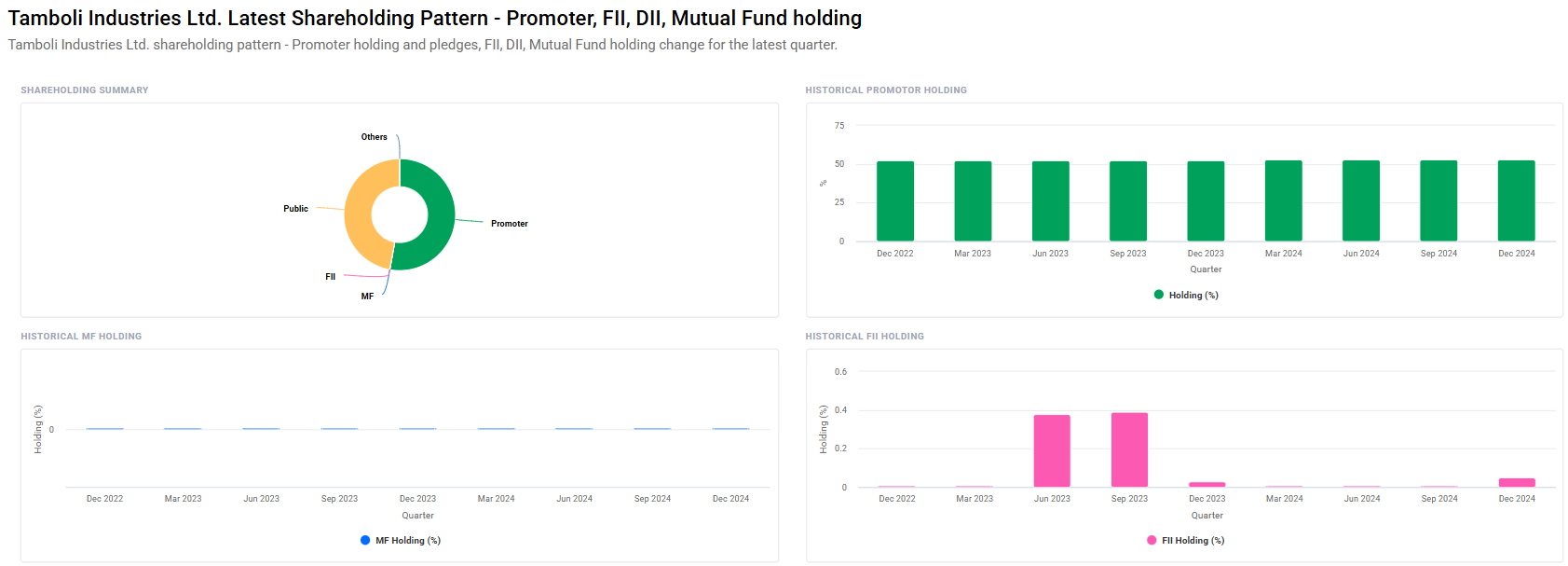

Ownership and Shareholding Pattern

- Promoters Holding: 52.83% (no change in the last quarter)

- Retail and Others: 47.12%

- Foreign Institutional Investors (FIIs): 0.05%

The stable promoter holding indicates ongoing belief in the company’s long-term vision, while retail holding is relatively high. Low level of FII indicates limited global exposure but minimizes the risk of foreign capital outflows.

Fundamental Insights

The following is the analysis of Tamboli Industries’ fundamentals today:

- Return on Capital (ROC): 5.92%

- Earnings per Share (EPS): 6.88

- Book Value: ₹112.77

- Industry P/E: 17.73

- Dividend Yield: 0.84%

The EPS of 6.88 and Book Value of ₹112.77 indicate that the stock is reasonably close to its intrinsic value. The fact that there is no reported P/E ratio would mean that net profit may have been volatile in the last few quarters.

Technical Analysis – Momentum and Market Sentiment

Below are the important technical indicators of Tamboli Industries Ltd.:

- MACD: 0.1, Bullish – Above center and signal line

- RSI (14): 57.4, Neutral – Not oversold or overbought

- ADX: 21.9, Weak trend – Waiting for direction

- ROC (21-day): 8.2, Positive momentum

- MFI: 70.2, Oversold zone – Possible pullback

- ATR: 11.4, Volatility – Moderate movement expected

Technically, the stock is neutral to bullish on a long-term basis, i.e., a possible breakout higher if positive market conditions prevail. RSI is in good health, whereas MFI implies caution on short-term entries.

Tamboli Industries Share Price Target (2025 to 2030)

On the premises of technical indication amalgamation, fundamental fortification, promoter firmness, and small-cap development potentiality, here is the future-focused price forecast of Tamboli Industries Ltd.:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹220 |

| 2026 | ₹320 |

| 2027 | ₹420 |

| 2028 | ₹520 |

| 2029 | ₹620 |

| 2030 | ₹720 |

Reason for Projection:

2025: Speculative recovery period with a likelihood to break the threshold above ₹215, courtesy to robust technical suggestions such as MACD and rise in retail investing.

2026: With company stabilization of earnings, market sentiment may push prices to ₹320, subject to earnings clarity and positive cash flows.

2027: Momentum phase; aided by long-term investors and potential dividend upgrade, target crosses ₹400.

2028: Business maturity, improved understanding of asset holding and returns, target range around ₹520.

2029: Market leadership in niche segments, performance of subsidiaries expanding, price approaches ₹620.

2030: Valuation catch-up, retail fervor at peak and long-term capital appreciation realization period, price peaking at around ₹720.

Investment Strategy

Short-Term Investors (Less than 1 Year)

- Risk Level: High

- Recommendation: Watch technical charts. Do not make a premature entry due to an excessively high MFI (overbought). Wait for corrections at ₹140-145.

- Exit Target: ₹180-₹220

Medium-Term Investors (2-3 Years)

- Risk Level: Moderate

- Recommendation: Tranche-wise buildup, particularly during market correction periods.

- Exit Target: ₹320-₹420

Long-Term Investors (5+ Years)

- Risk Level: Low

- Recommendation: Strong buy on long-term call for wealth generation. A sure bet on Indian industrial consolidation and small-cap boom.

- Exit Target: ₹620-₹720

Risks and Challenges

Though Tamboli Industries offers good growth opportunities, there are risks that investors must watch out for:

- Low Liquidity: Low volumes of trade on a daily basis, which poses a problem in coming in/out of big positions.

- Lack of Institutional Activity: Minimal FII or mutual fund activity can lead to price momentum to be decelerated.

- Earnings Visibility: Lack of clarity in consistent profit performance affects long-term valuations clarity.

- Overbought Technicals: Short-term drops are likely since MFI levels are high.

Frequently Asked Questions (FAQs)

Q1: Is Tamboli Industries to be bought today?

A: It has strong long-term potential, particularly for 3–5 year horizon investors. Yet, newer MFIs do indicate overbought, and thus entry may be on a pull-back.

Q2: Why no reported P/E is available for Tamboli Industries?

A: Unavailability of P/E ratio indicates the firm possibly not having recorded recent steady profits or there being some one-off adjustments made to its profitability.

Q3: Why Tamboli Industries would make a good long-term value investing opportunity?

A: Maintaining promoter holding, rising EPS, favorable book value, and positive momentum signs point towards probable long-term value generation.

Q4: Tamboli Industries’s share price must be what?

A: Based on current research, the share may rise up to around ₹720 by the year 2030 if the growth trend persists and market conditions remain favorable in the market.

Q5: Do Tamboli Industries pay dividends?

A: Information on dividends isn’t always on hand, which suggests earnings being reinvested. In some history, however, we’ve seen a 0.84% dividend yield.

Final Verdict – Invest or Not?

Tamboli Industries Ltd. can be one of the gems of the small-cap world. Although the stock is below its 52-week high, technicals indicate a potential breakout in the next few months. Long-term investors can use dips to build, while short-term traders may need to wait for confirmation before they take a buy.

With a positive mindset in a cautious manner and at the apt time, Tamboli Industries can guarantee multibagger returns by 2030.