Tata Motors Share Price Target Tomorrow 2025 To 2030

Tata Motors, established in 1945 as Tata Engineering and Locomotive Co. Ltd. (TELCO), is a leading Indian automobile manufacturer headquartered in Mumbai and a key part of the Tata Group. Initially focusing on locomotives, the company ventured into commercial vehicles in 1954 through a collaboration with Daimler-Benz. Over the years, Tata Motors has expanded its portfolio to include passenger cars, utility vehicles, trucks, buses, and defense vehicles. Notably, it acquired South Korea’s Daewoo Commercial Vehicles in 2004 and the British luxury carmaker Jaguar Land Rover in 2008, enhancing its global footprint. Tata Motors Share Price on NSE as of 26 April 2025 is 654.15 INR.

Tata Motors Share Market Overview

- Open: 668.35

- High: 673.00

- Low: 651.50

- Previous Close: 668.35

- Volume: 13,207,043

- Value (Lacs): 86,539.15

- VWAP: 658.76

- UC Limit: 735.15

- LC Limit: 601.55

- 52 Week High: 1,179.00

- 52 Week Low: 535.75

- Mkt Cap (Rs. Cr.): 241,220

- Face Value: 2

Tata Motors Share Price Chart

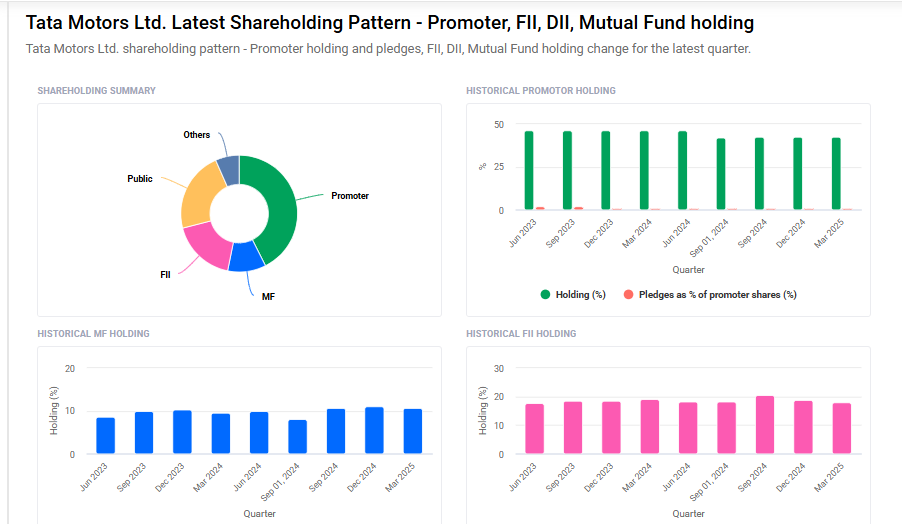

Tata Motors Shareholding Pattern

- Promoters: 42.6%

- FII: 17.8%

- DII: 17.2%

- Public: 22.4%

Tata Motors Share Price Target Tomorrow 2025 To 2030

| Tata Motors Share Price Target Years | Tata Motors Share Price |

| 2025 | ₹1200 |

| 2026 | ₹1250 |

| 2027 | ₹1300 |

| 2028 | ₹1350 |

| 2029 | ₹1400 |

| 2030 | ₹1450 |

Tata Motors Share Price Target 2025

Here are four key factors that could influence the growth of Tata Motors’ share price by 2025:

1. Strong Focus on Electric Vehicles (EVs)

Tata Motors is leading India’s electric vehicle market and plans to more than double its EV charging stations to 400,000 within the next two years. This expansion aims to alleviate concerns about EV range and charging infrastructure, potentially boosting EV adoption and sales.

2. Robust SUV and Multi-Powertrain Strategy

The company has identified SUVs, CNG, and EVs as key growth drivers. With a strong product portfolio and new model launches, Tata Motors is well-positioned to meet diverse customer preferences and drive sales growth.

3. Infrastructure Development Boosting Commercial Vehicle Demand

India’s significant capital expenditure on infrastructure, including long-term interest-free loans for states, is expected to boost economic activity and create demand for commercial vehicles. This macroeconomic factor could positively impact Tata Motors’ commercial vehicle segment.

4. Strategic Expansion of Jaguar Land Rover (JLR) Operations

Tata Motors plans to manufacture Jaguar Land Rover luxury cars at a new $1 billion plant in Tamil Nadu, India. This move aims to reduce costs and increase competitiveness in the luxury segment, potentially enhancing profitability.

Tata Motors Share Price Target 2030

Here are four risks and challenges that could influence Tata Motors’ share price by 2030:

1. Margin Pressures at Jaguar Land Rover (JLR)

Tata Motors’ subsidiary, Jaguar Land Rover, is experiencing margin pressures due to weak global demand, rising costs, and a normalizing product mix. These factors can impact profitability and, in turn, affect Tata Motors’ overall financial performance.

2. Fluctuating Raw Material Costs

The automotive industry is susceptible to changes in raw material prices. Tata Motors has had to increase vehicle prices to offset rising input costs, which could dampen demand, especially in price-sensitive markets like India.

3. Intense Market Competition

Tata Motors faces stiff competition from domestic players like Maruti Suzuki and Hyundai, as well as international EV manufacturers. This competitive landscape may challenge Tata Motors’ market share and profitability.

4. Dependence on EV Adoption Rates

Tata Motors aims for electric vehicles to constitute 50% of its portfolio by 2030. However, this goal is contingent on the pace of EV adoption, infrastructure development, and consumer acceptance, which remain uncertain factors.

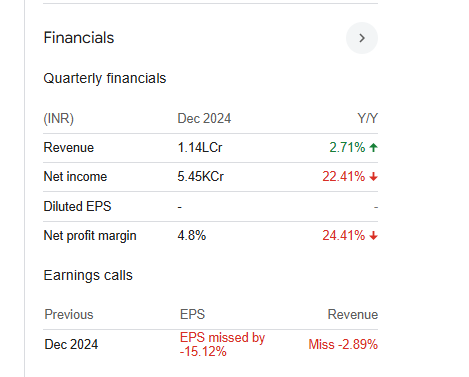

Tata Motors Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 4.38T | 26.58% |

| Operating expense | 1.57T | 22.31% |

| Net income | 313.99B | 1,200.55% |

| Net profit margin | 7.17 | 924.29% |

| Earnings per share | 84.43 | 3,833.91% |

| EBITDA | 485.43B | 123.09% |

| Effective tax rate | -13.78% | — |

Read Also:- Jio Finance Share Price Target Tomorrow 2025 To 2030