Thermax Ltd Share Price Target Tomorrow 2025 To 2030

Thermax Ltd is a well-known Indian company that provides energy and environment solutions. It helps industries become more efficient by offering products like boilers, cooling systems, and water treatment plants. The company also focuses on clean energy, helping customers reduce their carbon footprint through sustainable technologies. Thermax Ltd Share Price on NSE as of 21 May 2025 is 3,506.00 INR.

Thermax Ltd Share Market Overview

- Open: 3,554.60

- High: 3,578.80

- Low: 3,488.00

- Previous Close: 3,512.90

- Volume: 130,644

- Value (Lacs): 4,574.89

- 52 Week High: 5,839.95

- 52 Week Low: 2,950.05

- Mkt Cap (Rs. Cr.): 41,726

- Face Value: 2

Thermax Ltd Share Price Chart

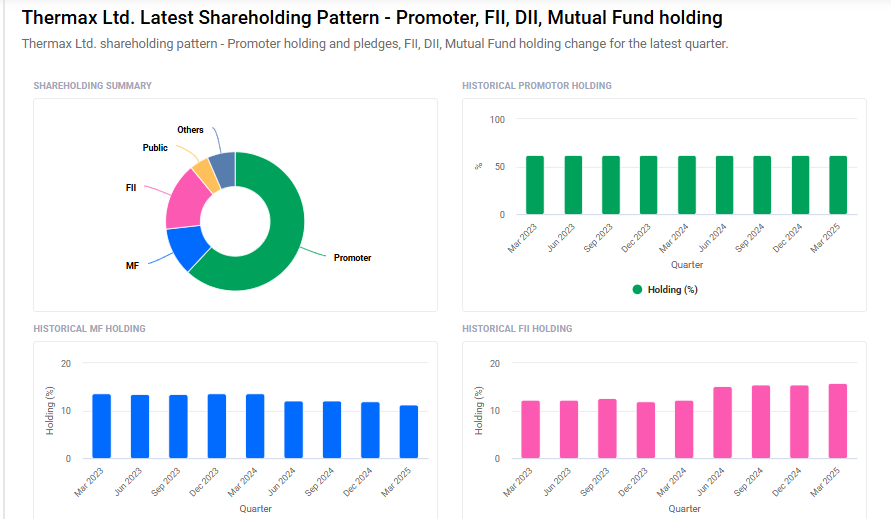

Thermax Ltd Shareholding Pattern

- Promoters: 62%

- FII: 15.9%

- DII: 12.3%

- Public: 4.4%

- Other: 5.5%

Thermax Ltd Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹5,840 |

| 2026 | ₹6950 |

| 2027 | ₹7845 |

| 2028 | ₹9037 |

| 2029 | ₹10,153 |

| 2030 | ₹11,250 |

Thermax Ltd Share Price Target 2025

Thermax Ltd share price target 2025 Expected target could ₹5,840. Here are 5 key factors influencing the growth of Thermax Ltd’s share price target for 2025:

-

Government Infrastructure Spending: Thermax is poised to benefit from increased government capital expenditure, particularly in the power and infrastructure sectors. The FY25 budget anticipates a 10-12% year-over-year growth in capital expenditure, which could positively impact Thermax’s order inflows and revenue.

-

Focus on Clean Energy and Sustainability: Thermax’s strategic emphasis on clean energy solutions, including green hydrogen and renewable energy, aligns with global sustainability trends. The company plans to deploy 1 gigawatt of hybrid renewable energy solutions within the next three years, positioning itself to capitalize on the growing demand for sustainable energy.

-

Diversified Order Book and Sectoral Demand: Thermax has a diversified order book with increasing demand from sectors such as chemicals, food and beverages, textiles, and distilleries. This broad sectoral presence enhances revenue stability and growth prospects.

-

Financial Performance and Profitability: The company reported a 15.24% increase in annual revenue and a 42.57% rise in net profit for FY2024, indicating strong financial health. This robust performance supports investor confidence and contributes to share price appreciation.

-

Analyst and Investor Sentiment: Thermax has received positive evaluations from analysts, with firms like HDFC Securities maintaining a ‘buy’ recommendation and setting target prices reflecting potential growth. Such endorsements can influence investor sentiment and drive share price targets upward.

Thermax Ltd Share Price Target 2030

Thermax Ltd share price target 2030 Expected target could ₹11,250. Here are 5 key risks and challenges that could impact Thermax Ltd’s share price target by 2030:

-

Global Economic Volatility: Thermax’s operations are sensitive to global economic conditions. Factors such as inflation, geopolitical tensions (e.g., conflicts affecting trade routes like the Red Sea), and economic slowdowns can disrupt supply chains and reduce industrial investments, potentially impacting the company’s revenue and profitability.

-

Regulatory Changes and Environmental Policies: As a company involved in energy and environmental solutions, Thermax is subject to various environmental regulations. Changes in policies, such as stricter emission norms or shifts in renewable energy incentives, could increase compliance costs or necessitate operational adjustments, affecting financial performance.

-

Intensifying Competition: The industrial equipment and clean energy sectors are becoming increasingly competitive, with both established players and new entrants vying for market share. This heightened competition can lead to pricing pressures and may require Thermax to invest more in innovation and marketing to maintain its position.

-

Technological Disruptions: Rapid advancements in technology could render existing products or solutions obsolete. Thermax must continuously invest in research and development to keep pace with technological changes and evolving customer preferences, which could strain resources and affect margins.

-

Supply Chain Dependencies: Thermax’s reliance on global supply chains for raw materials and components exposes it to risks such as delays, increased costs, and shortages. Events like pandemics, trade restrictions, or logistical challenges can disrupt supply chains, affecting production schedules and profitability.

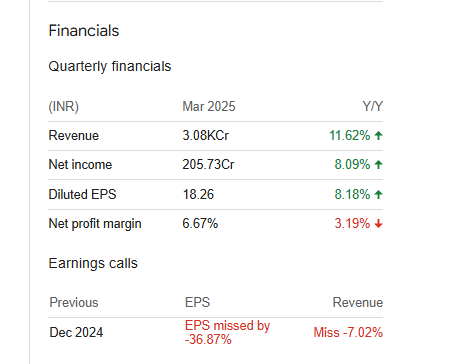

Thermax Ltd Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 30.85B | 11.62% |

| Operating expense | 10.86B | 14.03% |

| Net income | 2.06B | 8.09% |

| Net profit margin | 6.67 | -3.19% |

| Earnings per share | 18.26 | 8.18% |

| EBITDA | 2.94B | 9.61% |

| Effective tax rate | 31.63% | — |

Read Also:- Jupiter Wagons Share Price Target Tomorrow 2025 To 2030