Vedanta Share Price Target Tomorrow 2025 To 2030

Vedanta Limited is one of India’s leading natural resources and mining companies. It operates across different sectors like zinc, copper, aluminium, iron ore, oil and gas, and power. With a strong presence both in India and abroad, Vedanta plays an important role in supporting the country’s industrial growth. The company focuses on sustainable mining practices and aims to balance economic growth with environmental responsibility. Over the years, Vedanta has made significant investments to expand its operations and adopt new technologies. Vedanta Share Price on NSE as of 28 April 2025 is 412.30 INR.

Vedanta Share Market Overview

- Open: 422.85

- High: 425.80

- Low: 409.50

- Previous Close: 420.25

- Volume: 11,205,671

- Value (Lacs): 46,313.04

- 52 Week High: 526.95

- 52 Week Low: 208.00

- Mkt Cap (Rs. Cr.): 161,616

- Face Value: 1

Vedanta Share Price Chart

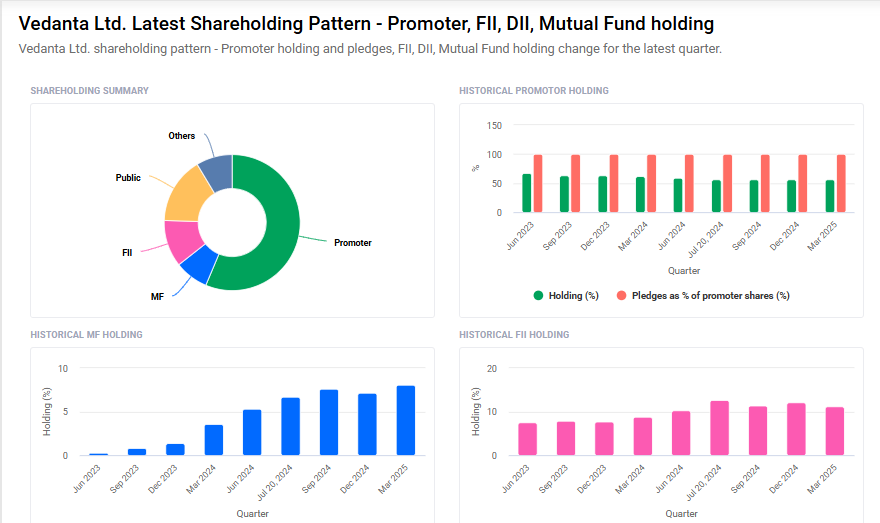

Vedanta Shareholding Pattern

- Promoters: 56.4%

- FII: 11.2%

- DII: 16.5%

- Public: 15.9%

Vedanta Share Price Target Tomorrow 2025 To 2030

| Vedanta Share Price Target Years | Vedanta Share Price |

| 2025 | ₹530 |

| 2026 | ₹550 |

| 2027 | ₹570 |

| 2028 | ₹600 |

| 2029 | ₹620 |

| 2030 | ₹650 |

Vedanta Share Price Target 2025

Here are 4 key factors affecting the growth for Vedanta Share Price Target 2025:

1. Commodity Prices Movement:

Vedanta’s business depends a lot on the prices of metals like zinc, aluminum, copper, and iron ore. If global commodity prices rise, Vedanta’s earnings can grow, which can positively impact its share price.

2. Expansion Projects and Investments:

Vedanta has been investing in expanding its mining and metal production capacity. Successful execution of these projects can boost future revenues and support share price growth.

3. Global and Indian Economic Conditions:

Since Vedanta’s products are used in many industries, a strong economy — both globally and within India — can increase demand for metals, helping the company perform better.

4. Regulatory and Government Support:

Supportive government policies in mining, energy, and environmental clearances can make it easier for Vedanta to grow its business, which would be good news for its share price.

Vedanta Share Price Target 2030

Here are 4 risks and challenges for Vedanta Share Price Target 2030:

1. Volatility in Commodity Prices:

Vedanta’s profits heavily depend on the prices of metals and natural resources. If global commodity prices fall sharply, it can hurt the company’s revenue and lead to pressure on its share price.

2. Environmental and Regulatory Risks:

Mining and metal production are closely watched for environmental impacts. Stricter regulations, delays in approvals, or penalties for non-compliance could negatively affect Vedanta’s operations and financial health.

3. High Debt Levels:

Vedanta carries a significant amount of debt. If the company struggles to manage or reduce its debt, it could lead to higher financial costs and lower profitability, affecting investor confidence.

4. Global Economic Slowdowns:

If major economies face a slowdown or recession, the demand for metals and energy could drop. This weaker demand might reduce Vedanta’s earnings and put pressure on its share price growth over the long term.

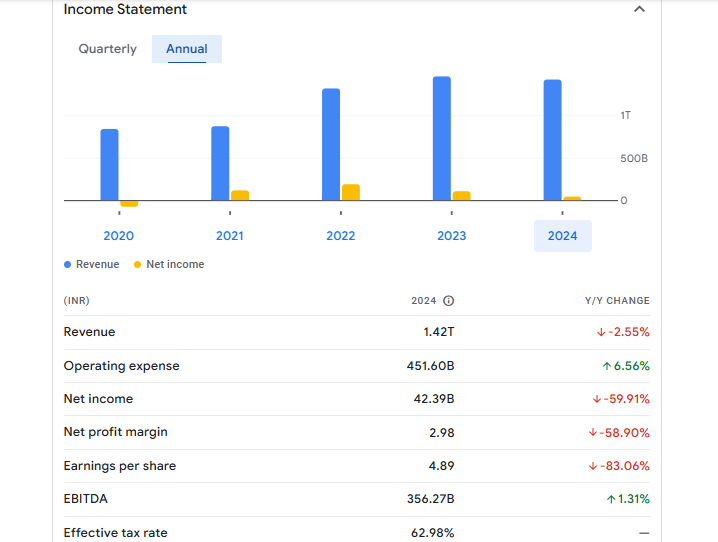

Vedanta Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 1.42T | -2.55% |

| Operating expense | 451.60B | 6.56% |

| Net income | 42.39B | -59.91% |

| Net profit margin | 2.98 | -58.90% |

| Earnings per share | 4.89 | -83.06% |

| EBITDA | 356.27B | 1.31% |

| Effective tax rate | 62.98% | — |

Read Also:- Coal India Share Price Target Tomorrow 2025 To 2030