Astral Share Price Target Tomorrow 2025 To 2030

Astral Limited is a well-known company in India, mainly involved in manufacturing pipes, fittings, and adhesives used in construction and plumbing work. The company has built a strong brand over the years and is trusted for its quality products and innovative solutions. Astral’s shares are listed on the stock exchange and attract many investors due to its consistent growth and strong financial performance. Astral Share Price on NSE as of 23 April 2025 is 1,368.50 INR.

Astral Share Market Overview

- Open: 1,338.00

- High: 1,397.70

- Low: 1,338.00

- Previous Close: 1,336.70

- Volume: 1,052,588

- Value (Lacs): 14,405.72

- Mkt Cap (Rs. Cr.): 36,765

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 2,454.00

- 52 Week Low: 1,232.30

- Face Value: 1

Astral Share Price Chart

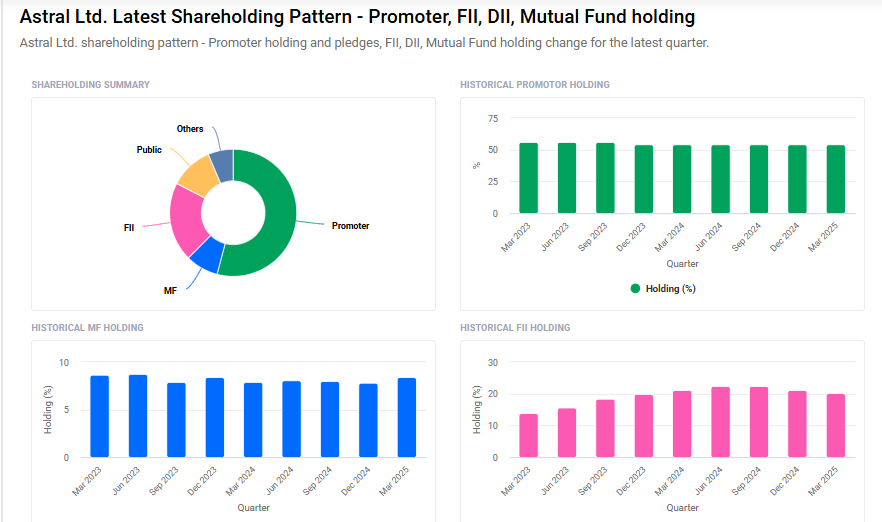

Astral Shareholding Pattern

- Promoters: 54.1%

- FII: 20.2%

- DII: 14.8%

- Public: 11%

Astral Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹2460

- 2026 – ₹2643

- 2027 – ₹2840

- 2028 – ₹3054

- 2030 – ₹3280

Major Factors Affecting Astral Share Price

Here are six key factors that influence the share price of Astral Ltd:

1. Financial Performance

Astral’s share price is closely tied to its financial results. For instance, in Q3 FY25, the company reported a net profit of ₹114.10 crore, marking a 0.53% increase compared to the same period last year. Consistent earnings growth can boost investor confidence and positively impact the share price.

2. Market Valuation

Analysts assess whether a stock is overvalued or undervalued by comparing its intrinsic value to the current market price. As of April 2025, Astral’s intrinsic value is estimated at ₹471.78 per share, while the market price is around ₹1,368.60, suggesting the stock may be overvalued by approximately 66%.

3. Competitive Landscape

Astral operates in the plastics sector, where competition from companies like Supreme Industries and Finolex Industries can influence its market share and profitability. Strong competition may impact Astral’s pricing power and, consequently, its share price.

4. Economic and Industry Trends

Broader economic factors, such as government infrastructure spending, urbanization, and demand in the housing and irrigation sectors, can affect Astral’s business. For example, increased government focus on water infrastructure has been a key growth driver for the plastic pipes segment.

5. Operational Efficiency

Astral’s ability to manage costs and maintain operational efficiency plays a role in its profitability. In Q3 FY25, the company’s net profit margin stood at 8.10%, reflecting its operational performance.

6. Investor Sentiment and Market Trends

Investor perception and market trends can influence Astral’s share price. Positive news, such as expansion plans or favorable industry developments, can boost investor sentiment, while negative news may have the opposite effect.

Risks and Challenges for Astral Share Price

Here are six key risks and challenges that could influence the share price of Astral Ltd:

1. Raw Material Price Volatility

Astral’s profitability is sensitive to fluctuations in raw material costs, particularly PVC and other chemicals used in manufacturing pipes and adhesives. Significant price changes can impact margins and earnings.

2. Inventory Losses Due to Price Corrections

The company has faced inventory losses when PVC prices declined sharply. Such losses can affect financial performance and investor confidence.

3. High Valuation Concerns

Astral’s stock is trading at a high price-to-earnings (P/E) ratio, which may raise concerns about overvaluation. If earnings do not grow as expected, the share price could be at risk of correction.

4. Macroeconomic Challenges

Broader economic issues, such as persistent inflation and weak urban demand, can impact Astral’s sales and profitability. These factors may influence investor sentiment and the company’s stock performance.

5. Competitive Market Environment

Astral operates in a competitive industry with several players. Intense competition can affect market share and pricing power, influencing the company’s financial health and share price.

6. Institutional Investor Sentiment

Changes in institutional investor holdings can impact Astral’s share price. A shift in sentiment among large investors may lead to significant stock price movements.

Read Also:- NLC Share Price Target Tomorrow 2025 To 2030