BEML Share Price Target Tomorrow 2025 To 2030

BEML Limited, formerly known as Bharat Earth Movers Limited, is a prominent Indian public sector company established in 1964. Headquartered in Bengaluru, BEML operates under the Ministry of Defence and plays a vital role in supporting India’s core sectors: Defence & Aerospace, Mining & Construction, and Rail & Metro. The company manufactures a diverse range of heavy equipment, including earthmovers, military vehicles, metro coaches, and rail wagons, serving both domestic and international markets. BEML Share Price on NSE as of 7 May 2025 is 3,100.00 INR.

BEML Share Market Overview

- Open: 3,235.00

- High: 3,280.00

- Low: 3,000.00

- Previous Close: 3,232.80

- Volume: 416,409

- Value (Lacs): 12,948.65

- 52 Week High: 5,488.00

- 52 Week Low: 2,350.00

- Mkt Cap (Rs. Cr.): 12,949

- Face Value: 10

BEML Share Price Chart

BEML Shareholding Pattern

- Promoters: 54%

- FII: 7.3%

- DII: 18.7%

- Public: 20%

BEML Share Price Target Tomorrow 2025 To 2030

| BEML Share Price Target Years | BEML Share Price |

| 2025 | ₹5500 |

| 2026 | ₹5700 |

| 2027 | ₹5900 |

| 2028 | ₹6100 |

| 2029 | ₹6300 |

| 2030 | ₹6500 |

BEML Share Price Target 2025

BEML share price target 2025 Expected target could ₹5500. Here are four key factors that could influence BEML’s share price target by 2025:

1. Strong Order Book and Export Growth

BEML is focusing on expanding its export markets, particularly in ASEAN and West Asia, with projected revenues of ₹1,500–2,000 crore from metro coach exports. The company is also advancing in the rail sector with new projects, including Vande Bharat sleeper trains and high-speed train prototypes, while emphasizing localization and execution in mining equipment manufacturing.

2. Strategic Partnerships and Technological Advancements

BEML has forged a strategic partnership with STX Engine to expand its footprint into defense and marine engine technologies. Additionally, the company is collaborating with Ricardo to develop and integrate next-generation propulsion systems, aiming to enhance operational efficiency and performance in extreme conditions.

3. Capital Expenditure and Business Restructuring

The company plans a capital expenditure of ₹1,000–1,500 crore in the coming years to meet its growth targets, including expanding existing plants and modernizing facilities. This investment is expected to generate a compound annual growth rate (CAGR) of 20% and improve the company’s EBITDA to 17–20%.

4. Brand Revitalization and Market Diversification

BEML unveiled its new brand identity, ‘Infinix,’ at the Aero India 2025 show, symbolizing the company’s evolution and commitment to innovation and excellence. This rebranding reflects BEML’s aspirations to diversify into aerospace, naval, and maritime sectors, aiming to scale up operations and contribute to India’s strategic growth.

BEML Share Price Target 2030

BEML share price target 2030 Expected target could ₹6500. Here are four key Risks and Challenges that could impact BEML’s share price target by 2030:

1. High Valuation and Market Volatility

BEML’s current price-to-earnings (P/E) ratio stands at approximately 49.47, which is significantly higher than the industry average. Such elevated valuations may not be sustainable if the company’s earnings growth does not keep pace with investor expectations. Additionally, the stock has experienced notable volatility, with a 27.12% decline over the past six months, highlighting its sensitivity to market fluctuations.

2. Exposure to Economic Cycles and Sectoral Risks

BEML operates across sectors like mining, defense, and railways, which are inherently cyclical and susceptible to economic downturns. A slowdown in infrastructure spending or delays in government projects could adversely affect the company’s order inflows and revenue streams. Moreover, the capital-intensive nature of its business makes it vulnerable to shifts in policy and budgetary allocations.

3. Intensifying Global Competition

The global market for electric drive mining trucks is projected to grow, attracting major players such as Caterpillar, Komatsu, and Terex Corporation. BEML faces the challenge of competing with these established international manufacturers, which could impact its market share and pricing power, especially in export markets.

4. Dependence on Government Contracts and Policy Changes

A significant portion of BEML’s revenue is derived from government contracts in sectors like defense and railways. Any changes in government policies, procurement procedures, or budgetary constraints could lead to order delays or cancellations, affecting the company’s financial performance and investor confidence.

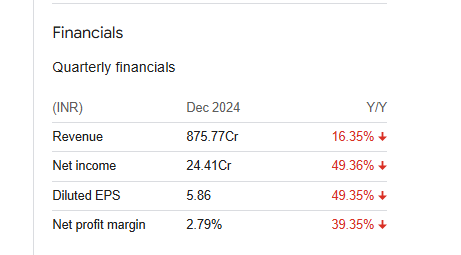

BEML Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 40.54B | 3.99% |

| Operating expense | 14.93B | 5.71% |

| Net income | 2.82B | 78.45% |

| Net profit margin | 6.95 | 71.60% |

| Earnings per share | 67.66 | 78.48% |

| EBITDA | 4.40B | 19.57% |

| Effective tax rate | 26.16% | — |

Read Also:- Mercury Trade Share Price Target Tomorrow 2025 To 2030