Cochin Shipyard Share Price Target Tomorrow 2025 To 2030

Cochin Shipyard Limited (CSL), established in 1972 and located in Kochi, Kerala, is one of India’s leading shipbuilding and ship repair companies. Operating under the Ministry of Ports, Shipping, and Waterways, CSL has built and repaired a wide range of vessels, including tankers, bulk carriers, passenger ships, and India’s first indigenous aircraft carrier, INS Vikrant. Cochin Shipyard Share Price on NSE as of 5 May 2025 is 1,529.80 INR.

Cochin Shipyard Share Market Overview

- Open: 1,595.00

- High: 1,599.00

- Low: 1,524.30

- Previous Close: 1,591.40

- Volume: 3,159,168

- Value (Lacs): 48,341.59

- 52 Week High: 2,979.45

- 52 Week Low: 1,168.00

- Mkt Cap (Rs. Cr.): 40,256

- Face Value: 10

Cochin Shipyard Share Price Chart

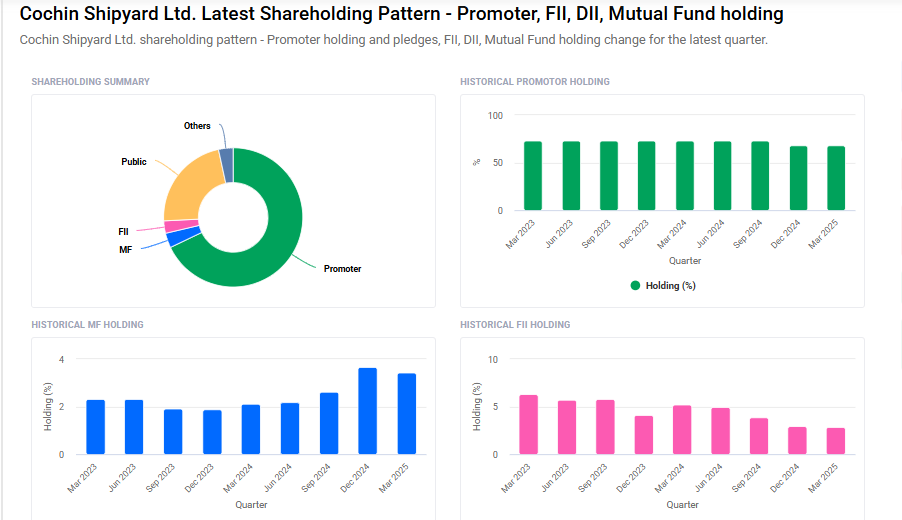

Cochin Shipyard Shareholding Pattern

- Promoters: 67.9%

- FII: 2.9%

- DII: 6.8%

- Public: 22.4%

Cochin Shipyard Share Price Target Tomorrow 2025 To 2030

| Cochin Shipyard Share Price Target Years | Cochin Shipyard Share Price |

| 2025 | ₹2980 |

| 2026 | ₹2300 |

| 2027 | ₹2600 |

| 2028 | ₹2900 |

| 2029 | ₹3200 |

| 2030 | ₹3500 |

Cochin Shipyard Share Price Target 2025

Cochin Shipyard share price target 2025 Expected target could ₹2980. Here are four key factors that could influence the growth of Cochin Shipyard Ltd. (CSL):

1. Robust Defense Contracts

CSL has secured significant defense contracts, including a ₹10,000 crore agreement to construct six Next Generation Missile Vessels (NGMVs) for the Indian Navy. These projects not only ensure a steady revenue stream but also reinforce CSL’s position in the defense sector.

2. Expansion of Ship Repair Market

The global ship repair market is projected to grow at a compound annual growth rate (CAGR) of 9.1%, reaching $42.87 billion by 2025. CSL’s strategic initiatives, such as the Memorandum of Understanding with Drydocks World to develop ship repair clusters, position the company to capitalize on this expanding market.

3. Strong Financial Performance

CSL has demonstrated impressive financial returns, with a total return of 25.29% over the past year and an astounding 1,285.95% over the last five years. The company also declared a 70% dividend, amounting to ₹3.5 per share, reflecting its commitment to shareholder value.

4. Government Support and Strategic Initiatives

The Indian government’s Maritime India Vision 2030 aims to enhance domestic shipbuilding capacity, providing a favorable environment for CSL’s growth. CSL’s planned ₹2,000 crore expansion at Cochin Port aligns with this vision, aiming to increase production capabilities and meet future demand.

Cochin Shipyard Share Price Target 2030

Cochin Shipyard share price target 2030 Expected target could ₹3500. Here are four key risks and challenges that could impact Cochin Shipyard Ltd. (CSL):

1. Dependence on Government Contracts

A major portion of Cochin Shipyard’s revenue comes from government and defense-related orders. Any delay, cancellation, or reduction in such contracts could significantly affect its financial stability and future growth.

2. Global Economic Uncertainty

The shipbuilding and repair industry is sensitive to global trade cycles and economic conditions. A slowdown in global maritime activity or disruptions like geopolitical tensions or recessions could reduce demand for new ships and repairs.

3. Rising Input and Labor Costs

Inflation and rising prices of raw materials such as steel, as well as skilled labor shortages, may increase operational costs. If not managed efficiently, this could impact profit margins and long-term competitiveness.

4. Technological and Competitive Pressure

The global shipbuilding industry is evolving rapidly with the adoption of green and smart technologies. CSL may face challenges from technologically advanced international competitors if it fails to innovate or upgrade its infrastructure in time.

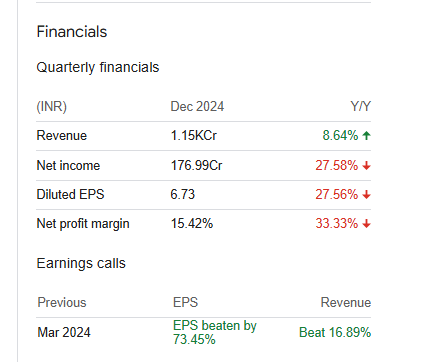

Cochin Shipyard Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 38.31B | 61.99% |

| Operating expense | 6.79B | 34.48% |

| Net income | 7.83B | 157.06% |

| Net profit margin | — | — |

| Earnings per share | 30.91 | 113.65% |

| EBITDA | 8.99B | 164.88% |

| Effective tax rate | 26.86% | — |

Read Also:- Bhagwati Autocast Share Price Target Tomorrow 2025 To 2030