Denta Water and Infra Solutions Share Price Target Tomorrow 2025 To 2030

Denta Water and Infra Solutions Ltd., based in Bangalore, is a growing company specializing in water management and infrastructure projects. The company focuses on designing, installing, and commissioning water infrastructure, including groundwater recharging systems, and also undertakes construction projects in railways and highways.

Denta Water’s financial performance shows a stock P/E ratio of 13.1, a return on capital employed (ROCE) of 60.5%, and a return on equity (ROE) of 44.4%, reflecting strong profitability metrics. The company has completed 32 water management projects and, as of November 30, 2024, has 17 ongoing projects with a total contract value of approximately ₹1,100 crore. Denta Water and Infra Solutions Share Price on NSE as of 15 April 2025 is 299.45 INR.

Denta Water and Infra Solutions Share Market Overview

- Open: 297.00

- High: 300.00

- Low: 295.15

- Previous Close: 293.95

- Volume: 56,805

- Value (Lacs): 169.62

- VWAP: 298.49

- UC Limit: 352.70

- LC Limit: 235.20

- 52 Week High: 377.70

- 52 Week Low: 251.25

- Mkt Cap (Rs. Cr.): 797

- Face Value: 10

Denta Water and Infra Solutions Share Price Chart

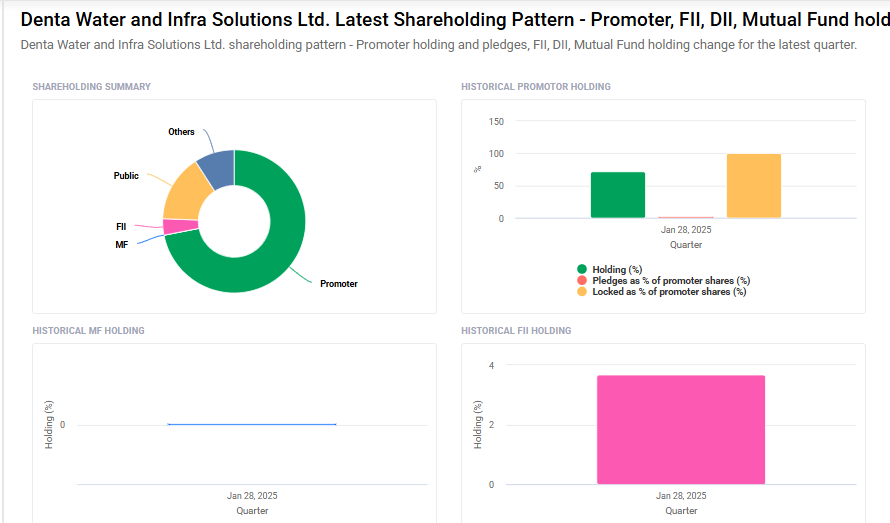

Denta Water and Infra Solutions Shareholding Pattern

- Promoters: 71.9%

- FII: 3.7%

- DII: 9.1%

- Public: 15.3%

Denta Water and Infra Solutions Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹380

- 2026 – ₹420

- 2027 – ₹460

- 2028 – ₹500

- 2029 – ₹540

- 2030 – ₹580

Major Factors Affecting Denta Water and Infra Solutions Share Price

Here are six key factors that influence the share price of Denta Water and Infra Solutions Ltd:

1. Strong IPO Performance and Investor Demand

Denta Water’s initial public offering (IPO) in January 2025 was met with overwhelming investor interest, being oversubscribed by over 221 times. The shares listed at ₹325, a 10.5% premium over the issue price of ₹294, and closed 16% higher on debut. Such strong demand and positive listing performance can boost investor confidence and positively impact the share price.

2. Government Initiatives and Infrastructure Projects

The extension of the Jal Jeevan Mission until 2028, as announced in the Union Budget 2025, has positively influenced Denta Water’s share price. The company’s involvement in water management infrastructure projects aligns with this mission, potentially leading to increased business opportunities and revenue growth.

3. Financial Performance and Profitability

In the December 2024 quarter, Denta Water reported net sales of ₹51.35 crore, marking a 12.87% year-on-year increase. Consistent revenue growth and profitability are crucial factors that can attract investors and support a higher share price.

4. Valuation Metrics

Denta Water’s stock is valued at a price-to-earnings (P/E) ratio of 13.1, which is lower than the industry average of 31.5. This suggests that the stock may be undervalued compared to its peers, potentially making it an attractive investment opportunity.

5. Market Sentiment and Trading Activity

The company’s shares have experienced significant trading activity since listing, with the share price ranging between ₹251.25 and ₹377.70 over the past year. Such volatility can influence investor sentiment and impact the share price in the short term.

6. Sectoral Growth and Economic Factors

As a player in the infrastructure and water management sector, Denta Water’s performance is influenced by broader economic factors and government spending on infrastructure projects. Increased investment in infrastructure development can lead to more project opportunities for the company, potentially boosting its share price.

Risks and Challenges for Denta Water and Infra Solutions Share Price

Here are six key risks and challenges that could influence the share price of Denta Water and Infra Solutions Ltd:

1. Heavy Dependence on Government Contracts

Denta Water relies significantly on government projects, especially from the Government of Karnataka. In the first half of FY25, approximately 84% of its revenue came from government contracts. This heavy dependence means that any changes in government policies, delays in project execution, or payment issues can adversely affect the company’s financial performance and, consequently, its share price.

2. Legal and Regulatory Challenges

The company and its promoter, Mr. C. Mruthyunjaya Swamy, have faced anonymous complaints alleging corrupt practices and misuse of authority. While these are allegations, any adverse findings or ongoing investigations can harm the company’s reputation and investor confidence, potentially impacting the share price.

3. High Attrition Among Key Personnel

Denta Water has experienced significant turnover among its key management personnel, including the resignation of two Chief Financial Officers within a year. Such high attrition can disrupt the company’s operations, affect strategic decision-making, and raise concerns among investors about the company’s stability.

4. Geographical Concentration Risk

The company’s operations are primarily concentrated in Karnataka. This geographical concentration exposes Denta Water to regional risks, such as local economic downturns, political changes, or natural disasters, which can impact project execution and revenue generation.

5. Competitive Industry Landscape

The water infrastructure sector is highly competitive, with numerous players vying for government contracts. This intense competition can lead to pressure on profit margins and may require the company to bid aggressively, potentially affecting profitability and share price.

6. Cash Flow Management Concerns

While Denta Water has reported profits, its operating cash flow is relatively low compared to its net profit. For the year ending March 31, 2024, the operating cash flow was ₹26.89 crore against a net profit of ₹59.73 crore. This discrepancy indicates potential challenges in cash flow management, which can affect the company’s ability to fund operations and growth initiatives.

Read Also:- Punjab and Sind Bank Share Price Target Tomorrow 2025 To 2030