IRB Infra Share Price Target Tomorrow 2025 To 2030

IRB Infrastructure Developers Ltd. is one of India’s leading companies in the field of road and highway construction. Established in 1998 and headquartered in Mumbai, the company has played a significant role in enhancing the country’s transportation network. IRB Infra specializes in Build-Operate-Transfer (BOT) projects and has been instrumental in developing major expressways, including the Mumbai-Pune Expressway. With a presence across 12 Indian states, the company manages over 15,500 lane kilometers of roads and operates numerous toll plazas, facilitating daily travel for millions. IRB Infra Share Price on NSE as of 30 April 2025 is 47.17 INR.

IRB Infra Share Market Overview

- Open: 47.30

- High: 47.90

- Low: 46.76

- Previous Close: 47.26

- Volume: 8,075,604.00

- Value (Lacs): 3,796.34

- 52 Week High: 78.15

- 52 Week Low: 40.96

- Mkt Cap (Rs. Cr.): 28,389

- Face Value: 10.00

IRB Infra Share Price Chart

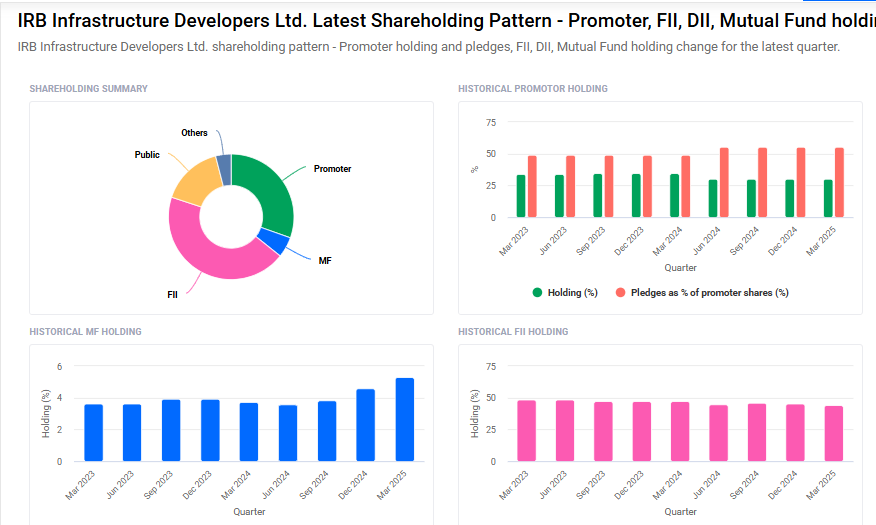

IRB Infra Shareholding Pattern

- Promoters: 30.4%

- FII: 44.3%

- DII: 9.4%

- Public: 15.9%

IRB Infra Share Price Target Tomorrow 2025 To 2030

| IRB Infra Share Price Target Years | IRB Infra Share Price |

| 2025 | ₹80 |

| 2026 | ₹100 |

| 2027 | ₹120 |

| 2028 | ₹140 |

| 2029 | ₹160 |

| 2030 | ₹180 |

IRB Infra Share Price Target 2025

Here are four key factors influencing the growth of IRB Infrastructure Developers Ltd. (IRB Infra) and its share price target for 2025::

1. Government Infrastructure Initiatives

IRB Infra stands to benefit significantly from the Indian government’s continued emphasis on infrastructure development. Programs like the Bharatmala Pariyojana and the National Infrastructure Pipeline (NIP) aim to expand the nation’s road network, providing ample opportunities for IRB Infra to secure new projects.

2. Robust Project Pipeline and Execution

The company’s strong order book, exceeding ₹13,700 crore, ensures revenue visibility for the next few years. Successful execution of major projects, such as the Vadodara-Kim Expressway and the Telangana HAM project, is expected to drive revenue growth and enhance investor confidence.

3. Diversification into New Sectors

IRB Infra is actively exploring opportunities beyond traditional road projects, including ventures into airports, urban infrastructure, and renewable energy sectors. This diversification strategy aims to reduce dependence on a single sector and tap into emerging markets, potentially boosting the company’s growth prospects.

4. Financial Health and Operational Efficiency

Maintaining a healthy debt-to-equity ratio and focusing on operational efficiency are central to IRB Infra’s strategy. The company’s efforts to manage costs effectively and improve profit margins contribute to its financial stability, which is crucial for sustaining growth and achieving favorable share price targets.

IRB Infra Share Price Target 2030

Here are four key Risks and Challenges that could affect IRB Infra’s share price target by 2030:

-

Regulatory and Policy Uncertainty

Changes in government regulations, toll policies, or delays in approvals for infrastructure projects can impact IRB Infra’s operations and project timelines, affecting investor confidence and revenue flow. -

High Debt and Financial Leverage

Being in a capital-intensive industry, IRB Infra often carries significant debt. Rising interest rates or inability to service debt efficiently may strain financial health and limit growth opportunities. -

Execution Delays and Cost Overruns

Infrastructure projects are vulnerable to delays due to land acquisition issues, legal hurdles, or contractor inefficiencies. These delays can lead to cost overruns and affect profitability. -

Economic and Demand Slowdowns

Broader economic slowdowns, especially in construction and transport sectors, could reduce traffic volumes and toll revenues on IRB’s roads, impacting long-term earnings and valuation.

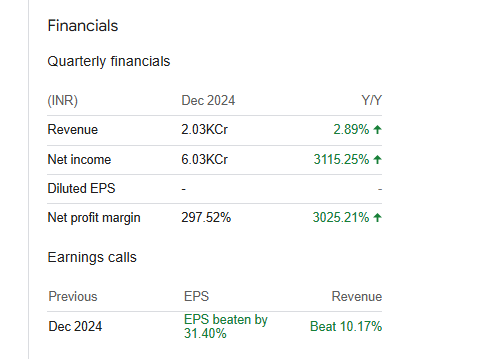

IRB Infra Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 74.09B | 15.74% |

| Operating expense | 17.69B | 17.67% |

| Net income | 6.06B | -15.86% |

| Net profit margin | 8.18 | -27.29% |

| Earnings per share | 1.00 | -15.97% |

| EBITDA | 33.28B | 3.13% |

| Effective tax rate | 36.33% | — |

Read Also:- REC Share Price Target Tomorrow 2025 To 2030