MTNL Share Price Target From 2025 to 2030

MTNL Share Price Target From 2025 to 2030: Investment in the share market requires immense knowledge about the company’s fundamentals, industry situation, ownership pattern, and technical signals. One of such shares which have been making news in the recent past is that of Mahanagar Telephone Nigam Limited (MTNL). Once a telecom colossus of India, MTNL has witnessed its fortunes wearing down over time. With digitalization being undertaken on a regular basis and government-funded telecom ventures, investors are keeping close tabs on the way the MTNL ride will unfold.

In this article, there is an in-depth overview of MTNL’s performance, fundamentals, technicals, shareholding pattern, and most notably, estimated 2025-2030 share price targets. In the event you intend investing in MTNL, this review will give you details needed to make informed decisions.

Company Overview and Market Position

Mahanagar Telephone Nigam Ltd. is a government-owned telecommunication services company having significant operations in Mumbai and Delhi. It was a large urban telecom services company but was facing stiff competition from private operators, which led to financial and operational strain.

But with more emphasis on digital connectivity, broadband penetration, and India’s vision of making telecom infrastructure ubiquitous, MTNL is at a potential turning point. Government action and the degree of merger or restructuring with BSNL would provide that much-needed push to MTNL to turn the corner.

Key Strengths:

- Government Ownership: Buffer support from the government.

- Infrastructure Assets: Huge holding of land, towers, and telecom towers in two large metro cities.

- Restructuring Opportunities: Value can be unleashed through strategic mergers and asset monetization.

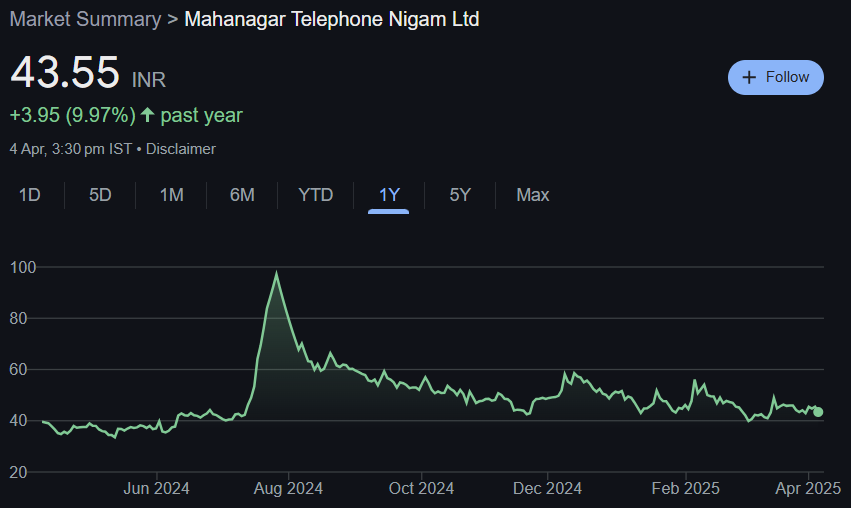

Current Performance in the Stock Market

As of the latest update:

- Open Price: ₹44.54

- High Price: ₹45.31

- Low Price: ₹42.85

- Current Price: ₹43.55

- Market Capitalization: ₹2,740 Crores

- 52-Week High: ₹101.93

- 52-Week Low: ₹32.55

- Volume: 37,70,702

- Total Traded Value: ₹18.43 Crores

- Upper Circuit: ₹52.28

- Lower Circuit: ₹34.85

Shares have come back about 10% over the past 12 months but are nowhere near their 52-week high. MTNL is a volatile stock, and that is why it is appealing to short-term speculators and traders.

Fundamental Indicators

Fundamental facts regarding MTNL highlight the issues it is facing:

- P/E Ratio (TTM): -0.83

- EPS (TTM): -₹52.12

- Book Value: -₹401.39

- Return on Capital (ROC): 13.00%

- Industry P/E: 53.47

- Debt to Equity: -1.23

- Dividend Yield: 0.00%

These numbers reveal that MTNL is operating on a net loss today, and its negative book value reflects an over-levered balance sheet. However, the ROC of 13% reflects that the capital employed is positive-returning one, which perhaps one can cling to in case of any pick-up in operating efficiency.

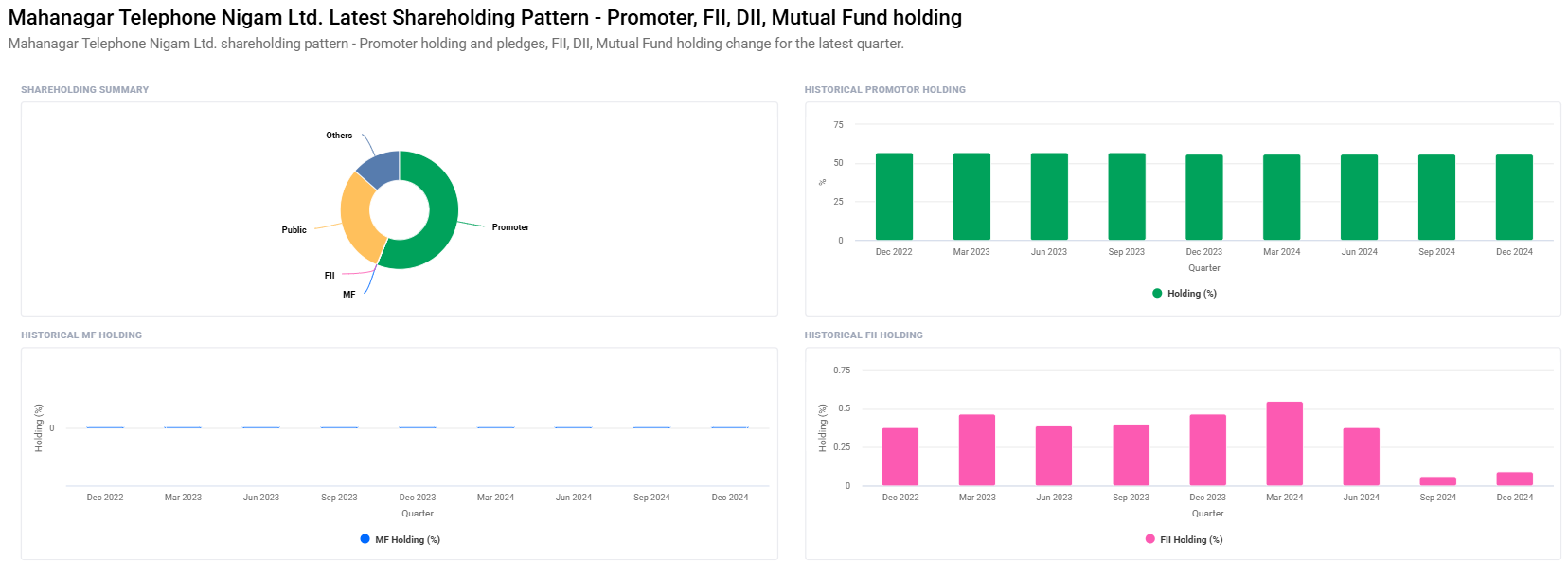

Shareholding Pattern and Institutional Sentiment

Let us look at the shareholding pattern in detail:

- Promoters (Govt. of India): 56.25% (no change)

- Retail & Others: 30.17%

- Domestic Institutions: 13.49%

- Foreign Institutional Investors (FII/FPI): 0.09% (from 0.06%)

- Number of FII/FPI Investors: From 34 to 38

- Mutual Fund Holding: 0.00% (no change)

Stability of promoters and small increase in FII involvement suggest confidence returning, but slowly. Absence of mutual fund holding, however, suggests institutional conviction still lacking. For long-term investors, this could be an early indication of potential accumulation opportunity.

Technical Analysis – Weak to Neutral Signs

Here’s what the day’s technical indicators are suggesting:

- RSI (14): 46.3, Neutral (not oversold or overbought)

- MACD: -0.3, Bearish

- MACD: Signal -0.4, Bearish

- ADX: 11.7, Weak Trend

- Momentum Score: 38.2, Neutral

- ROC (21 days): +7.1, Short-term Momentum Positive

- ROC (125 days): -20.6, Long-term Momentum Negative

- MFI: 40.6, Neutral

- ATR (Volatility Index): 2.7, Moderate Volatility

The charts show that MTNL is moving sideways with weak negative bias, particularly on the long side. The traders can wait for more choppy action until a breakout at high volume. A level above ₹52.28 would be most likely a breakout from its current range.

MTNL Share Price Target (2025-2030)

Keeping in mind the operational turnaround potential, asset monetization, govt. restructuring, and rising telecom demand, these are the target share price levels for MTNL:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹110 |

| 2026 | ₹180 |

| 2027 | ₹250 |

| 2028 | ₹320 |

| 2029 | ₹400 |

| 2030 | ₹480 |

Note: Assumptions subject to government policy support, overhaul of strategy, and telecom growth.

Investment Strategy – To Invest or Not to Invest in MTNL

Short-Term Investors (1–2 Years)

- Risk Level: High

- Strategy: Enter between ₹43–₹46; exit around ₹110 in 2025 if good news continues.

- Stop Loss: ₹34.85 (lower circuit)

Medium-Term Investors (3-5 Years)

- Risk Level: Moderate

- Strategy: Build on the fall, i.e.; achieve ₹250 by 2027.

- Note: Keep track of government announcements and restructuring plans.

Long-Term Investors (5+ Years)

- Risk Level: Low to Moderate (on assumption of continued government support)

- Strategy: Risk as turnaround bet; high likelihood of material gain by 2030 if resurrection works.

- Exit Target: ₹480+

Risks and Challenges

- High Debt and Losses: Balance sheet of the company is under pressure.

- Negative Book Value: Indicates more liabilities than assets.

- Competitive Market: Jio, Airtel, and Vi dominate the telecom sector.

- Government Dependence: Restructuring or bailout delay can jeopardize turning around plans.

- Investor Sentiment: Low FII and mutual fund holding is a risk aversion sign.

Final Verdict – Is MTNL a Good Investment?

MTNL is not a classic value investment nowadays for value investors. It is a high-reward, high-risk opportunity—best consumed with patience and an appetite for PSU turnarounds.

Although the fundamentals are currently weak, strategic support, potential restructuring, and business turnaround can release a huge value. As long as reforms do happen, MTNL can offer multi-bagger returns by 2030. The investors must stay abreast of significant news and follow a staggered investment strategy.

FAQs – MTNL Share Price Forecast

Q1. MTNL share price target in 2025 is what?

A: Because of positive government restructuring and support programs, MTNL’s 2025 share price target is ₹110.

Q2. Is MTNL a good long-term investment?

A: MTNL can be a turnaround story. Providing that government restructuring and rollout support of 5G turn out to be successful, it can be a good earnings long-term investment by 2030.

Q3. Why is MTNL’s P/E ratio negative?

A: P/E ratio is negative due to negative earnings per share (EPS) indicating that the company is currently making losses.

Q4. What is the promoter holding in MTNL?

A: Promoter holding (Government of India) for the current quarter is 56.25%, indicative of support continuity.

Q5. What are the key risks in investing in MTNL?

A: Principal threats are high indebtedness, inefficiencies in operations, negative value, and brutal competition from private telecom market leaders.

Q6. Is MTNL to be merged with BSNL?

A: Although not announced officially, there is credible speculation and occasional government thinking of merging MTNL with BSNL, which will improve MTNL’s finances as well as operational performance.